Many investors attempt to seek out stock investments in the same way as Warren Buffett. Warren Buffett has often cited the screens he uses in uncovering companies that meet his investment criteria. Standard & Poor's created a list of companies that currently meet Mr. Buffett's screening criteria. S&P did add a discounted cash flow screen as an additional factor in in order to eliminate overvalued companies. The screens used by Mr. Buffett are:

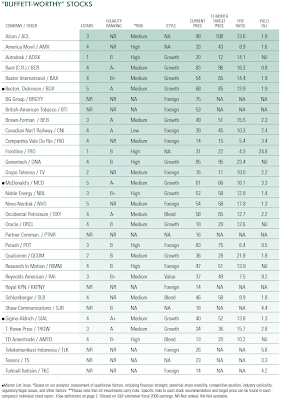

The companies passing all the above screens are detailed in the below table.

- Free cash flow (net income after taxes, plus depreciation and amortization, less capital expenditures) of at least $250 million.

- Net profit margin of 15% or more.

- Return on equity of at least 15% for each of the past three years and the most recent quarter.

- A dollar’s worth of retained earnings creating at least a dollar’s worth of shareholder value over the past five years.

- Ample liquidity. Only stocks with a market capitalization of at least $500 million are included.

- (S&P's) Comparing the five-year discounted cash flow (DCF) estimate with the current price.

(click to enlarge)

Source:

Source:Acing The Buffett Test ($)

The Outlook

Standard & Poor's

By: Howard Silverblatt, Senior Index Analyst

January 14, 2009

http://erecom.standardandpoors.com/ecommerce/multiRegistration.do

Disclosure: Long BCR, MCD, SLB

1 comment :

I think those screens are a good place to start.

My only concern is the use of the DCF methodology and the inherent difficulties in forecasting earnings.

Charlie Munger has always told people that he has never actually seen Warren do a DCF valuation.

In the recent book "Snowball" (by Alice Schroeder), there is a revealing part in the book where Buffett obtains a huge "directory" on Korean stocks and goes through it methodically looking for businesses producing essential items with large market share and trading at low price-earnings ratios, cash balances to market capitalization etc.

I have always felt that he does not do any real DCF analysis in the way that some have written about it in certain books.

Really like your site.

Post a Comment