|

| From HORAN Capital Advisors |

|

| From HORAN Capital Advisors |

|

| From HORAN Capital Advisors |

|

| From HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

11:00 AM

0

comments

![]()

![]()

Labels: Commodities , Economy

|

| From HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:45 PM

0

comments

![]()

![]()

Labels: Valuation

|

| From HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:53 AM

0

comments

![]()

![]()

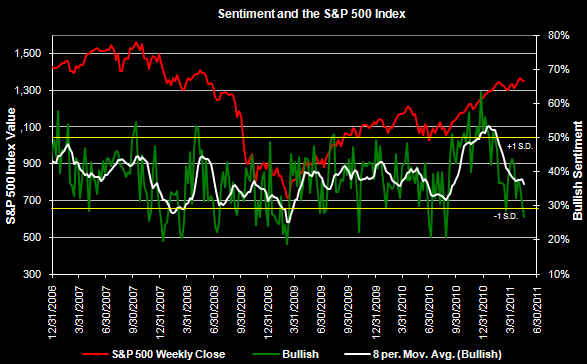

Labels: Sentiment

|

| From HORAN Capital Advisors |

|

| From HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:00 PM

0

comments

![]()

![]()

Labels: Commodities

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

1:29 PM

0

comments

![]()

![]()

Labels: Economy , General Market , Sentiment , Technicals

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:56 PM

2

comments

![]()

![]()

Labels: Dividend Analysis

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

4:44 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:25 PM

0

comments

![]()

![]()

Labels: General Market , Sentiment

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

8:59 PM

0

comments

![]()

![]()

Labels: Dividend Return

|

| From The Blog of HORAN Capital Advisors |

- The estimated growth rate for earnings in Q1 for S&P 500 companies is 18%.

- The forward four quarter P/E ratio for the S&P 500 Index stands at 12.9.

- Through the end of April, 324 companies have reported earnings, with 84% either exceeding or meeting expectations.

- Companies are reporting earnings that are 7% above estimates which is greater than the 2% longer term average surprise factor.

Posted by

David Templeton, CFA

at

12:03 PM

0

comments

![]()

![]()

Labels: General Market , Investments , Valuation