Once again the equity put/call ratio moved above 1.0 at the close on Friday, reaching 1.04. The equity P/C ratio tends to measure the sentiment of the individual investor by dividing put volume by call volume. At the extremes, this particular measure is a contrarian one; hence, P/C ratios above 1.0 signal overly bearish sentiment from the individual investor. This indicator's average over the last 5-years is approximately .7, indicating the individual investor has been generally mostly bullish and more active on the call volume side.

For the institutional investor, technical analyst generally consider the index put/call ratio as a reflection of institutional sentiment. The index P/C ratio is slightly elevated at 1.53 and above its 5-year average of 1.4; however, in August 2007, the index P/C ratio stood at 2.7. Some would consider the current level of the index P/C as neither a bearish or bullish market sign at this time.

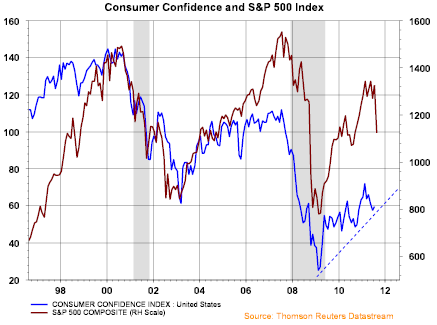

At HORAN, we believe business fundamentals are contrasting with equity market actions. This divergence is being driven in large part by the lack of confidence in Europe in dealing with its sovereign debt issues and in Washington's inability to deal with its budget deficit. Additionally, the amount of regulatory uncertainty that includes health care reform and potential income tax reform is a factor in business' ability to commit to longer term expansion plans. All of this also weighs negatively on consumer confidence and sentiment as well.

As the below chart shows, consumer confidence remains in an uptrend since early 2009; however, since February 2011 the confidence trend has been declining.

Lastly, there are some positive economic data points.

- Industrial production in July was reported at .9% versus expectations of .5%. May and June industrial production were revised higher as well.

- Leading economic indicators index increased .5% versus expectations of a .2% increase.

- The Conference Board's coincident economic index (CEI) increased .3% with all four of its components increasing. Industrial production is a component of the CEI.