This market cycle has been tough on dividend growth type stocks. A number of past dividend growers have resorted to cutting dividend payouts due to the difficult economic environment. Admittedly, many of the adverse dividend actions have been centered in the financial sector. In this environment though, there are firms that are increasing their payouts to investors.

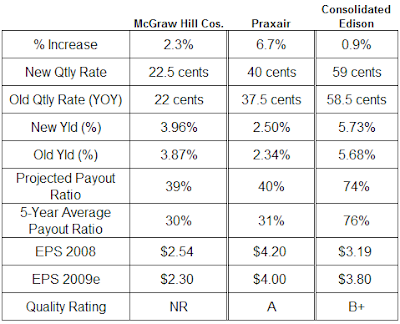

Below is detail on company's that announced increases in the company's dividend over the last several days. The companies detailed below are McGraw Hill Companies (MHP), Praxair (PX) and Consolidated Edison (ED).

Below is detail on company's that announced increases in the company's dividend over the last several days. The companies detailed below are McGraw Hill Companies (MHP), Praxair (PX) and Consolidated Edison (ED).

(click to enlarge)

(click to enlarge)

3 comments :

What happens if you own an ETF that supposedly buys dividend producing stocks? Do they sell the stocks that stop giving dividends?

Don the libertarian Democrat

Don,

Each dividend etf may handle changes in the holdings depending on the stated benchmark for the etf. The etf prospectus should discuss this issue.

If the etf's benchmark is the S&P's Aristocrats, the etf should adjust holdings in the same manner as S&P changes their index holdings. Following is how S&P accounts for Aristocrats index changes

Index constituent weight adjustments occur after the closing of the third Friday of each

quarter ending month.

Index constituent membership is reviewed once a year in December. The reference date for such additions and deletions is after the closing of the last trading date of November.

Index constituents may be deleted from the index for the following reasons:

• During the December rebalancing, if the company’s calendar year dividends did not increase from the previous calendar year

• Between rebalancings, if the stock is removed from the S&P 500

David,

Thank you.

Don the lD

Post a Comment