For the U.S. government's fiscal year ending September 30, 2008 the total federal debt level reached $10 trillion. Michael Pakko, an economist with the Federal Reserve Bank of St. Louis, notes in a recent article that the rise in government spending and debt is a ticking time bomb. What contributes to the debt explosion is the rise in entitlement programs.

All told, the shortfall for government social insurance programs (Social Security, unfunded obligations of Medicare Part A & B and Medicare Part D-prescription drug coverage) comes to a present value of $40.9 trillion. This is the government’s official estimate—some private sector economists suggest that the total burden is even greater. Economist Lawrence Kotlikoff has recently estimated the total unfunded liabilities of current federal programs at $70 trillion.

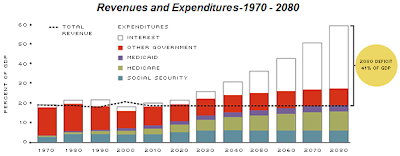

Recent bailout actions are also contributing to the rise in obligations that will need to be repaid by U.S. taxpayers. Forecasts from the Government Accountability Office show the growth of the debt obligations if entitlement reforms are note undertaken. The below graph depicts the growth in expenses compared to total revenue as a percent of GDP out to 2080.

(click to enlarge)

and the resulting growth in the government's debt:

and the resulting growth in the government's debt:(click to enlarge)

The ballooning deficits and debt levels are issues that will need to be addressed sooner versus later in order to ensure healthy economic growth in the long run. Michael Pakko concludes:

Current measures of the federal deficit and the national debt, as dismal as they might appear, fail to reflect full consequences of current-law fiscal policy. The unfunded future liabilities of government entitlement programs imply rising deficits and a ballooning public debt far larger than today’s shortfalls. And debates about the immediate economic impact of government deficits on private savings and interest rates, while of academic interest, fail to address the full importance of these long-run consequences. Fundamental reform of entitlement programs is critical for putting U.S. fiscal policy on a long-run sustainable path.

Source:

Deficits, Debt and Looming Disaster: Reform of Entitlement Programs May Be the Only Hope

The Regional Economist

By: Michael Pakko

January 2009

http://www.stlouisfed.org/publications/re/2009/a/pages/debts.html

No comments :

Post a Comment