The spreadsheet below details performance information for each ofthe Aristocrats. It shouldbe noted the Anheuser-Busch was removed from the S&P 500 Index as of November 18th due to it being acquired by InBev (INBVF).

Posted by

David Templeton, CFA

at

3:34 PM

0

comments

![]()

![]()

Labels: Dividend Return

| Company | Symbol | S&P Rank | Market Cap | Dividend Yield | Debt/Cap | % Above 52-week Low |

|---|---|---|---|---|---|---|

| Sysco Corp | SYY | A+ | $13.4B | 3.94% | 31.9% | 13.1% |

| Johnson & Johnson | JNJ | A+ | $161.7B | 3.16% | 23.7% | 12.5% |

| Pepsico | PEP | A+ | $85.3B | 3.10% | 31.6% | 14.0% |

| General Dynamics | GD | A+ | $19.9B | 2.79% | 14.0% | 8.1% |

| Stryker Corp. | SYK | A+ | $15.6B | .86% | .4% | 10.0% |

| Danaher | DHR | A+ | $17.2B | .22% | 21.0% | 13.8% |

Posted by

David Templeton, CFA

at

4:27 PM

4

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

4:55 PM

2

comments

![]()

![]()

Labels: General Market , Investments

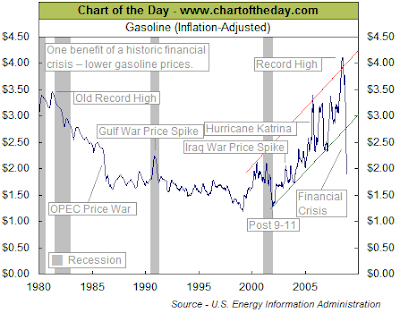

Source: Chart of the Day

Source: Chart of the Day

Posted by

David Templeton, CFA

at

6:23 PM

0

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

3:52 PM

2

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

12:46 PM

0

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

11:37 AM

0

comments

![]()

![]()

Labels: Sentiment

Posted by

David Templeton, CFA

at

12:12 AM

0

comments

![]()

![]()

Labels: Dividend Analysis

Dividend Investing

Top dividend stocks with reasonable payout ratios (MagicDiligence - Optimizing Joel Greenblatts Value Stock Strategy)

A potentially huge reward with an asset play in Value Vision Media Inc (VVTV). (Old School Value)

An in depth analysis of Sysco Corp (SYY). (Dividends 4 Life)

Even Berkshire-Hathaway's (BRK/A) stock is suffering in this market. (Intelligent Speculator)

Is Baidu.com's recent decline a buying opportunity? (Intelligent Speculator)

Screening the Forbes Best Small Companies list for investment opportunities. (Old School Value)

Can Citigroup regain its footing? (Smart Money).

Smith & Wesson & Ruger-are they shooting blanks? (Tough Money Love » Hard Truth and Tough Love for Money Problems and Personal Finance)

The losers in the Volkswagen and Porsche merger battle. (My Simple Trading System)

A review of the book Investing for Dummies. Maybe a good read for all investors? (Living Almost Large)

Insight into performing fundamental stock research. (Finance-Information)

Financial issues impacting individuals beyond just the stock market. (KCLau's Money Tips)

A primer on the Price to Earnings ratio or P/E. (Investing School)

10 better investments than the market. (Learn The Stock Market And How to Trade)

More bold predictions from Jim Rogers. (Subprime Blogger)

Does one quarter of negative GDP growth equal a recession? (The Political and Financial Markets Commentator)

Inflation protection strategies for ones portfolio. (FIRE Finance)

Tips on staying afloat in this market. (Beating The Stock Market)

Reduce fund expenses with Vanguard Admiral shares. (Free Money Finance)

Investments for a depression like economy. (Zignals blog)

Advice on getting your investments back on track. (The Iconoclast Investor)

Investing through TreasuryDirect. (Wealth Junkies)

Is your 401(k) account safe. (The Digerati Life)

A review of the best asset allocation on a historical basis. (Ripe Trade)

When analyzing a company, read the footnotes in the financial statement. (Value Investing and Entrepreneurship by Qovax)

The importance of choosing the right asset allocation. (The Sun’s Financial Diary)

Obama's energy plan may benefit these stocks. (The Green Investing Blog)

Don't fall for stock option "get rich quick" schemes. (Michael James on Money)

10 steps to building ones wealth. (Money Blue Book)

Tips on saving money by reducing household expenses. (Money Blog)

If one consolidates their debt, they need to cut their expenses too. (Finance Tips 101)

Posted by

David Templeton, CFA

at

5:30 AM

3

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

11:42 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

(I originally posted this article on The DIV-Net website on November 16, 2008)

The recent decline in equity prices and near record low interest rates, have enticed stock investors to focus on higher yielding dividend paying stocks. One must keep in mind though, a stock's dividend yield is not the same as comparing yields on certificates of deposit.

"After all, if one invests primarily for current income, it might seem logical that stocks with the highest yields would be best. The popularity of the “Dogs of the Dow” approach would seem to support that assumption. However, the Dow Dogs approach is designed to beat major averages through price appreciation; the high yield under that approach is merely an indicator of possible undervaluation."The stocks that trade at higher yields tend to be the ones that are at the highest risk of a dividend cut. Ideally, stocks with lower yields and the ones that grow the dividend on a regular basis tend to be the type of stock that outperforms the market over the long run.

This year's performance of the high dividend yield approach of the Dogs of the Dow strategy offers some evidence that a high yield approach does not always mean higher total return. The year to date return as of November 21, 2008 for the Dow Dogs equals -50.0% versus the return on the Dow Jones Index of -39.3%.

The dividend-discount model is based on the assumption that dividends ultimately drive share price. If a firm doubles its dividend over a certain time, its stock price should also double if interest rates do not change.

Thus, the percentage rate of dividend growth drives and equals the expected rate of increase in share price. From that equivalence, we can derive this formula for expected percentage total return:Expected Total Return =

Expected Dividend Growth Rate +

Current Dividend Yield

Posted by

David Templeton, CFA

at

5:30 AM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

4:32 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

11:18 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

- Since 1900, the Dow has undergone a major correction 26 times or one major correction every 4.2 years.

- Of the 26 major stock market correction since 1900, the current stock market correction currently ranks as the fourth largest in magnitude (only the corrections beginning in 1906, 1929, and 1937 were greater) and is the most severe stock market correction of the post-World War II era.

Posted by

David Templeton, CFA

at

7:44 AM

1

comments

![]()

![]()

Labels: General Market

Just a quick note regarding the American Association of Individual Investors' sentiment report released this morning. Individual investor bullish sentiment feel to 24.37% versus last week's reading of 38.33%. The bull/bear spread came in at -32.77% compared to last week's level of -4.17%. Along with my post on the investor sentiment cycle yesterday and this data point, maybe this serves as some confirmation that we are in the discouragement phase of the sentiment cycle.

Posted by

David Templeton, CFA

at

7:34 AM

0

comments

![]()

![]()

Labels: Sentiment

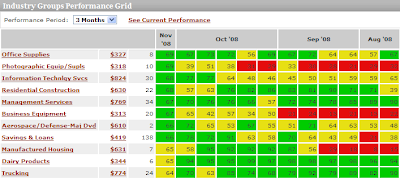

Source: Invivo Analytics

Source: Invivo Analytics

Posted by

David Templeton, CFA

at

10:34 PM

0

comments

![]()

![]()

Labels: Technicals

"That's not to say that I believe stocks have “hit their lows.” We always have to allow for the market to move significantly and unexpectedly, and there is plausible downside risk from here. Our activity as investors is not to try to identify tops and bottoms – it is to constantly align our exposure to risk in proportion to the return that we can expect from that risk, given prevailing evidence."

One of the fallacies about the recent financial turbulence is that the markets are in “uncharted territory” and that there are no historical precedents for the volatility, panic, or economic uncertainty that we've observed. To make statements like this is to admit that one has not examined historical evidence prior to the 1990's. The fact is that we've observed similar panics throughout market history. This decline has been deeper and more rapid than most, but that is largely a reflection of the rich valuation and overbought condition that characterized the market in 2007 (see the July 16, 2007 comment A Who's Who of Awful Times to Invest).

Posted by

David Templeton, CFA

at

8:37 PM

1

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

8:12 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Through war and recession, Americans have turned to the glistening canned product from Hormel as a way to save money while still putting something that resembles meat on the table. Now, in a sign of the times, it is happening again, and Hormel is cranking out as much Spam as its workers can produce.

Posted by

David Templeton, CFA

at

1:18 PM

1

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

3:23 PM

0

comments

![]()

![]()

Labels: Investments

One index to watch that might provide a clue to a pickup in global growth is the Baltic Dry Index. As the below chart notes shipping prices have declined significantly over the last several months. This is an indication that demand has fallen for overseas shipping vessels that often transport important commodities like iron ore and coal. More information on the Baltic Dry Index can be found at the below link.

- Bankruptcies and Plant Closings Rising in China (naked capitalism)

- Factory Closings and Unrest in China (naked capitalism)

- The Baltic Dry Index: The Only Economic Indicator Worth Tracking Right Now (ContrarianProfits)

Posted by

David Templeton, CFA

at

9:38 PM

0

comments

![]()

![]()

Labels: Economy , International

Posted by

David Templeton, CFA

at

9:51 PM

1

comments

![]()

![]()

Labels: Technicals

- reduction in consumer and government debt levels

- unwinding of derivatives exposure

- stopping the bailout of every company

- Obama's desire to uncap the payroll tax has very negative implications for businesses and individuals.

- Eliminating the deductibility of 401(k) contributions reduces the incentive to save. It is saving, and not spending, that more individuals need to make more of a habit.

- Increasing benefit costs related to health care provided by employers. This policy does not promote hiring.

Posted by

David Templeton, CFA

at

10:32 PM

2

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

8:25 PM

0

comments

![]()

![]()

Labels: General Market

"The most dangerous thing an investor can do is overreact in this kind of market," says Rick Adkins, a certified financial planner with Arkansas Financial Group. Instead of panic selling when share prices are plunging, wait a few days until you can make a rational decision to sell, not an emotional one.

Reasons not to sell are often forgotten at times of market turmoil. For one, many institutional investors are "looking to tap the irrational behavior of the individual investor," says Adkins. That means savvy money managers may be waiting to gobble up the shares you sold at bargain prices. That seems to be what happened earlier this week, when Janus Capital Corp. and others began buying stocks voraciously around midday Tuesday.

...In the last decade or so, the stock market has usually rebounded within days of a big sell-off. You can't count on a fast snap-back every time, of course. But if you start dumping shares, odds are you'll buy them back later at a higher price. (emphasis added) "If you thought that the stock you bought was good value yesterday, it's likely to be a good value today unless something fundamental has changed in the company's prospects," says Harold Evensky, a partner with Evensky, Brown & Katz, a financial planning firm.

“There are very attractive opportunities now,” says Bill Stromberg, director of global equities and of global equity research. “Companies in the heartland of industrial America, many technology companies, and many health care companies are thriving in this environment and reporting pretty good earnings. We’re trying to take advantage of widespread selling to pick them up cheap.

Stephen Wetzel, a financial planner and adjunct professor of financial planning at New York University, is far less circumspect. "I'm buying like a crazy man: value stocks, financial services, value funds, muni bonds, some international small cap. You don't get opportunities like this very often."

Posted by

David Templeton, CFA

at

2:35 PM

0

comments

![]()

![]()

Labels: General Market

(The following article was originally published on The DIV-Net website on November 2, 2008)

Posted by

David Templeton, CFA

at

5:30 AM

0

comments

![]()

![]()

Labels: General Market

It is not uncommon for global markets to become more correlated in severe bear markets. Maybe this higher correlation will be a positive when markets begin to recover?

It is not uncommon for global markets to become more correlated in severe bear markets. Maybe this higher correlation will be a positive when markets begin to recover?

Posted by

David Templeton, CFA

at

10:39 PM

0

comments

![]()

![]()

Labels: General Market

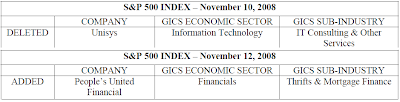

Today Standard & Poor's announced Unisys Corp. (UIS) would be replaced in the S&P 500 Index by People’s United Financial Inc. (PBCT). The UIS will be removed after the close of trading on November 10th and PBCT will be added after the close of trading on November 12th. Could this be a contrarian indicator indicating more favorable returns for technology?

Posted by

David Templeton, CFA

at

7:22 PM

0

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

8:24 AM

0

comments

![]()

![]()

Labels: Sentiment

Posted by

David Templeton, CFA

at

9:03 PM

0

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

10:19 PM

0

comments

![]()

![]()

Labels: Dividend Return

Posted by

David Templeton, CFA

at

10:01 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

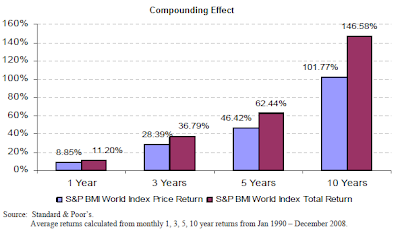

- Historically, dividends have contributed nearly one-third of the equity return of the S&P BMI World Index, while capital appreciation has contributed approximately two-thirds.

- When bond yields are low, income oriented investors can switch to dividend paying stocks to enhance current income.

- Dividends allow investors to capture the upside potential while providing downside protection in the down markets.

Lastly, the compounding of dividends adds significantly to the total return of ones investment. For the 18-year period from January 1990 to December 2008 the price only return for the S&P BMI World Index totaled 101.77% versus the total return (dividends included) on the World Index over that same time period of 146.58%.

Lastly, the compounding of dividends adds significantly to the total return of ones investment. For the 18-year period from January 1990 to December 2008 the price only return for the S&P BMI World Index totaled 101.77% versus the total return (dividends included) on the World Index over that same time period of 146.58%.

Posted by

David Templeton, CFA

at

1:38 PM

0

comments

![]()

![]()

Labels: Dividend Analysis , Dividend Return

Posted by

David Templeton, CFA

at

12:36 PM

0

comments

![]()

![]()

Labels: Investments

It has been said a number of times in this recent market environment, that the best time to buy stocks is when it feels the most uncomfortable. October made this difficult to believe given the punishment the market took in that month. In fact, Friday's (10/31/08) positive market advance was the first time the Dow Jones Industrial Average recorded two consecutive up days since September 26th.

It has been said a number of times in this recent market environment, that the best time to buy stocks is when it feels the most uncomfortable. October made this difficult to believe given the punishment the market took in that month. In fact, Friday's (10/31/08) positive market advance was the first time the Dow Jones Industrial Average recorded two consecutive up days since September 26th.

Posted by

David Templeton, CFA

at

12:41 PM

0

comments

![]()

![]()

Labels: General Market , Investments

Detail on the individual aristocrats is accessible in the below spreadsheet. The full aristocrats spreadsheet is viewable by clicking the Aristocrats link.

Detail on the individual aristocrats is accessible in the below spreadsheet. The full aristocrats spreadsheet is viewable by clicking the Aristocrats link.

Posted by

David Templeton, CFA

at

10:39 AM

1

comments

![]()

![]()

Labels: Dividend Return