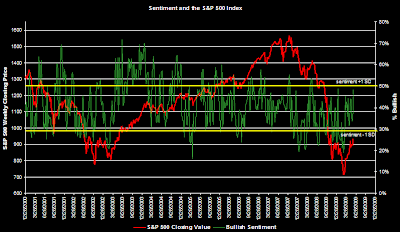

The American Association of Individual Investors (AAII) surveys its members on a monthly basis regarding investor asset allocation. These investors indicated they had 42% of their investments allocated to cash in December 2008. In the most recent survey (May 2009) investors indicated they had 35% of assets invested in the cash portion of their allocation. AAII's asset allocation survey goes back to 1987 and the average cash level since the survey began is 25%. Investors continue to be overweight cash versus the historical average.

The below chart graphs the cash allocation (red line), the S&P 500 Index (green line) and the 3-period moving average of the Bull/Bear Spread (white line). Given the various sentiment indicators, it does appear investors are still skeptical of the market's current level. From a contrarian perspective then, sentiment would indicate the market could continue to grind higher.

What is missing in all of the data to this point are truly positive factors and not simply less negative. One potentially positive data point could be company earnings reports in the second half of the year. The market tends to trade on expectations and companies will certainly have an easier time achieving earnings growth compared to the year earlier reported results.