The state of the market seems to have dictated many of the topics in this week's carnival. As the below posts note, many provide advice on how to handle this market volatility.

DIVIDEND INVESTING

The Dividend Guy Blog notes "there are 4 crucial factors a dividend investor must consider," in the post

The Four Most Important Metrics When Evaluating Dividend Stocks.

STOCK ANALYSIS

Dividends 4 Life presents

Stock Analysis: Pitney Bowes Inc. (PBI) noting, "Pitney Bowes Inc. is the world's largest maker of mailing systems, also provides production and document management equipment and facilities management services.

Linked here is a detailed stock analysis and commentary."

Central Europe & Russia Fund Inc. (CEE) Analysis - Revisited posted at

One Family's Blog, notes, "An analysis of CEE, a closed-end exchange traded fund (ETF) focused on Central Europe & Russia trading at a double-digit discount to NAV."

INVESTING

Your Finish Rich Plan presents

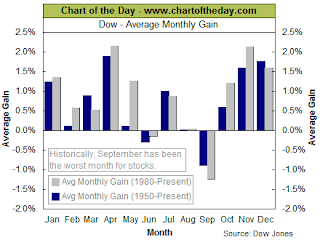

Understanding Stock Market Volatility: Perception vs. Reality noting, "The stock market can be very volatile in the short-run, but when considering longer time frames, it's not nearly as volatile and is actually quite predictable"

Triaging My Way To Financial Success presents

Capitulation Chaos: advising there is "A valuable insight into how to best position yourself for market volatility from a fellow value and dividend investor"

Invest In India presents

Are you disappointed with your mutual fund investments? noting "2008 has been tough on investors. This holds especially true for first-time investors. After having seen the markets surge to record highs, the downturn has certainly caught several investors off-guard."

MagicDiligence - Optimizing Joel Greenblatts Value Stock Strategy notes in the post,

The Problem with Investing in Banks, that "Magic Formula investors have luckily been spared from the calamity in financial stocks over the past year. But even in the best of times, banking is a risky industry that is difficult to properly value, and should be avoided by most individual investors."

FIRE Finance writes about some of the risk factors that impact the market in the post,

Investment Risks at a Glance.

The Financial Blogger notes in the post,

Is the apocalypse among us?, that "The US market is going down and major companies are following the trend. What is going on?"

The Simple Dollar's post

Using TreasuryDirect for Conservative Investing provides, "A basic description of how TreasuryDirect works and what you can invest in there."

The Iconoclast Investor offers insight into the recent market volatility,

10 Observations About This Financial Storm.

My Simple Trading System blog highlights two emotional factors that influence investors at the post,

Lehman, Merril Lynch, and AIG Lead to The "Unbubble".

In

Trader's Narrative's post,

TED Spread: Going Where No Spread Has Gone Before it is noted, "The TED spread is one of the most basic gauges of fear in the financial markets. TED stands for Treasury Eurodollar because originally it was calculated by taking the US 3 month treasury bill and subtracting it by the 3 month Eurodollar contract rate. Today the spread is calculated by taking the difference between the 3 month US T-bill rate and the 3 month LIBOR rate."

The Digerati Life's post provides insight on "What should an investor do during a turbulent stock market period?" at

Best Places For Your Money When The Stock Market TanksHow to Protect Yourself Against the Economic Crisis posted at

The Smarter Wallet, provides some timely investment advice during this volatile market period.

Doing Nothing Can Be a Strategic Response to a Market Crash posted at

Tough Money Love » Hard Truth and Tough Love for Money Problems and Personal Finance, saying, "When the market is in crisis, doing nothing can be a strategic response"

Some books and DVDs for a tough market at

Gift Ideas for Stock Market Junkies posted at

The Investor's JournalVALUE INVESTING

Barel Karsan writes about the Canadian furniture manufacturer Amisco and its cheap price to book ratio in the post,

Amisco: Liquidation Value.

WEALTH ACCUMULATION

Investment Internals notes at the post,

Money lessons to kid, that one should "teach your kid about money and how to deal with money at various ages and let them achieve financial wisdom when they start earning."

ALTERNATIVE INVESTMENTS

Passive Family Income provides a review of covered call transactions at

Wachovia Covered Call Contracts.

REAL ESTATE

Is It Possible that Housing Prices May Not Stabilize Until 2014? posted at

Fiscal Zen.

That concludes the fourteenth carnival edition. Submit your blog article to the next edition of

Investing Carnival using our

carnival submission form. Past posts and future hosts can be found on

The DIV-Net's blog carnival index page.