An important aspect to investing is determining where the markets might be headed based on macro factors. This is certainly why investment strategists parse the continual flow of economic data in an effort to determine the future course of the economy and the market. One potentially significant event is the aging of the baby boomers (individuals born between 1946-1964) and the decisions they will make regarding their investments.

Thomas Partners Investment Management (TPIM) recently analyzed market returns from 1986-2005. The strategy article notes:

It is interesting to note, however, that despite all the attention given to corporate earnings growth, well less than one half of the increase in portfolio values over that period can be attributed to the underlying earnings per share growth of the S&P 500 component companies! The balance, to the surprise of many investors, was due to increased Price/Earnings ratios ("P/E" ratios) and the reinvestment of dividend income.

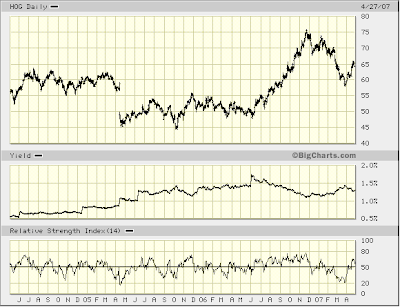

The article contains a number of graphs depicting the breakdown of the equity market returns since 1986. During the 1980s and 1990s investment managers attributed some of the strong equity market advances to P/E expansion that was supported by declining interest rates and low inflation. TPIM opines the other influence on P/E expansion was due to the fact baby boomers had moved into their prime wealth accumulation phase. This wealth accumulation resulted in a higher demand for equities as the boomers invested their wealth into the equity market; thus pushing up equity prices and expanding multiples.

As the baby boomers have aged, they have impacted society and the economy in various ways. In boomers pre-teen years, communities had to build more schools to accommodate the influx of students. Every kid wanted to own a Schwinn, once a popular bicycle brand. As the boomers moved onto SUVs and mini-vans, Schwinn ended up in bankruptcy. Given the fact 10,000 baby boomers will turn 60 every day (started in 2006) over the course of the next 17 years, what impact will this have on investment markets, specifically equities?

Thomas Partners theorizes:

If "growth-hungry" boomers drove P/E’s higher in the past, it is logical to assume that "income-hungry" boomers will drive P/E’s lower in the future. First, growth will not be the dominant investment goal; income will likely dominate. Second, higher current yields (caused in part by lower P/E’s) will be needed to support boomer retirement lifestyles. As such, the P/E ratio expansion that contributed so handsomely to equity returns in 1986 to 2005 will likely reverse and inhibit price appreciation for years to come.

TPIM believes equity market returns will average in the high single digits over the next 20 years. In an environment of single digit equity returns and multiple contraction, dividend income becomes a more important component of an investor's return. Additionally, it is believed boomers will desire, and companies will accommodate, higher dividend payments.

As noted in a

prior post, up to this point, companies have favored stock buybacks to dividend payments. With the payout ratio on the S&P 500 at a historical low of 30%, companies have the capability to increase dividends that are paid to shareholders. It is believed as boomers move into their retirement years, they will prefer owning less volatile dividend paying stocks and will demand higher dividends in return.

Finally, as TPIM notes and I have mentioned in prior posts:

Dividends make a difference in any portfolio and more current yield, earlier, plus more dividend growth, later, can significantly enhance long-term total returns.

Lastly, Stephen Crowe of

Eons interviewed Greg Thomas of Thomas Partners.

Before I touch on the interview, who or what is Eons. Eons is a site devoted to boomers. The site was started in mid 2006 by Jeff Taylor, the founder of Monster.com. Eons' mission statement:

Eons is a 50+ media company inspiring a generation of boomers and seniors to live the biggest life possible.

I mention Eons because this company is a reality because of the aging baby boomer population.

The site contains an

interview with Greg Thomas of Thomas Partners expounding on the benefits of a dividend growth portfolio. In Part III of the interview, Thomas responds to why more investors do not follow a dividend growth approach. His response:

"One is that income is very difficult to get excited about in any sort of a short-term measurement period," Thomas says. A dividend is too small to have much impact on total returns.

"Even if you have stock that is yielding 4 percent, the dividend in one quarter is only returning 1 percent," he notes. In the same time period, the price of a stock can change 5, 10 or 15 percent in any direction - far more noticeable.

A second reason why the dividend growth strategy is not widely practiced is the nature of the stocks themselves.

"The kinds of stocks that pay dividends, and particularly those that pay increasing dividends, rarely capture the excitement of the short-term marketplace," says Thomas.

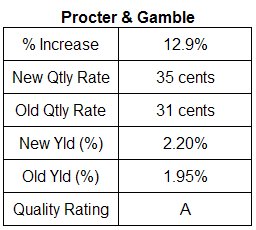

The dividend growth companies are the "steady eddies" of Wall Street - GE, MDU Resources, Procter & Gamble, McGraw Hill, to name a few.

"The market is a popularity contest in the short term," Thomas says. "And the last thing we want to be doing is always be buying the most popular kid on the block, because those things have a way of changing."

As the steady flow of boomers moves closer to retirement, I do believe one impact the aging baby boomers will have on equity markets is that of a greater demand for dividend growth equities. Additionally, those companies that are able to pay a higher dividend rate will see their stock prices likely increase at a faster pace than the market.

Sources:

Equity Markets: 1986-2025

Thomas Partners Investment Management

https://www.thomaspartnersinc.com/SHOREY/WEB/me.get?WEB.websections.show&SCH3490_274

Dividend Growth Portfolio: 'Steady Eddies' of Wall Street Drive Investment Strategy

Eons

By: Stephen Crowe

http://www.eons.com/money/feature/growthenestegg/11352