Sunday, June 26, 2011

Michael Mauboussin Interview: Challenging Investors' Behaviors

Posted by

David Templeton, CFA

at

9:07 AM

0

comments

![]()

![]()

Labels: General Market , Sentiment

Saturday, June 25, 2011

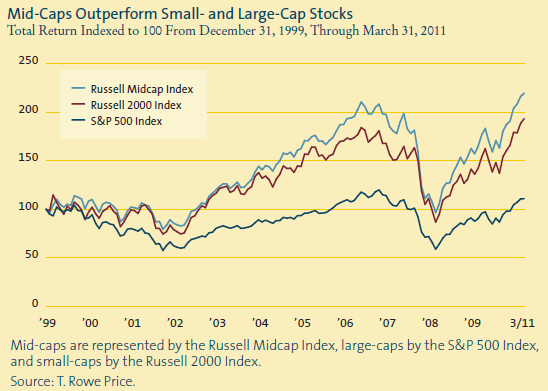

Mid Cap Relative Valuations At Historically High Levels

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

1:48 PM

0

comments

![]()

![]()

Labels: General Market , Valuation

Sunday, June 19, 2011

Market Adjusting To Slower Growth Economic Environment

Our positioning of our client portfolios maintains an overweight in health care (more defensive sector) and technology (generating strong earnings growth). We continue to maintain an underweight in the financial sector, more specifically in banks, due to our concern about their earnings growth ability in the near term given the large amount of regulation coming out of Washington D.C. Our portfolio structure continues to focus on reducing the volatility in our client investment accounts.

We do believe the economy is still growing, although at a slow pace. Some of the factors inhibiting growth are the result of supply chain disruptions caused by the tsunami in Japan and floods in the Midwest. We believe the recent market pullback is an adjustment to a slower growth global economic environment.

It is likely money flow into equities and out of bonds could pickup in the second half of this year coincident with better clarity on economic growth. The financial condition of most large companies is strong as they hold record levels of cash on their balance sheet and continue to deliver strong earnings results, although earnings comparisons become more difficult in the second quarter. These financially strong companies should provide better returns than the low rates available on treasuries. The recent market pullback seems to be providing investors underweight in equities with an opportunity to add to equity allocations and/or equity positions.

The equity put/call ratio at 1.1 is higher than the level reached at the market low in July 2010 and higher than the level at the market's low in March of 2009.

|

| From HORAN Capital Advisors |

|

| From HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

6:28 PM

0

comments

![]()

![]()

Labels: General Market , Sentiment , Technicals

Thursday, June 09, 2011

Bullish Investor Sentiment In Continued Downtrend

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:11 AM

0

comments

![]()

![]()

Labels: Sentiment

Monday, June 06, 2011

Market Is Looking Oversold

The percentage of stocks selling above their 50 day moving average has fallen to levels last seen during the March lows earlier this year. After the close today only 24% of S&P 500 stocks are trading above their 50 day moving average compared to 27% in March. Additionally, the percentage of stocks trading above their 150 day moving average is at a level last seen in the third quarter of 2010.

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:52 PM

0

comments

![]()

![]()

Labels: Technicals

Saturday, June 04, 2011

The Dow Struggles In The Month Of June

"[The] chart illustrates the Dow's average performance for each calendar month since 1950 (blue columns) and the average monthly performance of the Dow from 1950 to the present (gray line). [The] chart illustrates that the Dow has tended to perform best during the last several months and first several months of a calendar year. During the middle of a calendar year, the Dow has tended to struggle (with the exception of July). It is worth noting that there have been only two calendar months during which the Dow has declined on average -- June and September."

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

8:42 AM

0

comments

![]()

![]()

Labels: General Market

Wednesday, June 01, 2011

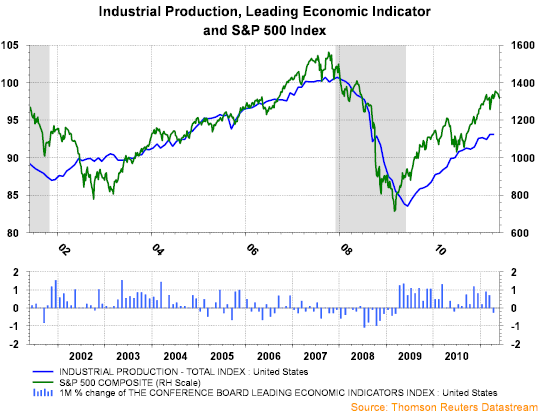

A Slow Growth Market Environment

The next support level for the S&P is 1,305; however, it is difficult to guess market bottoms. From a fundamental perspective though, valuations for large cap U.S. equities continue to look more and more attractive. The forward four quarter P/E ratio for the S&P 500 Index is 12.8 times based on projected earnings of $103.57 for the S&P 500.

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

The small down tick in the U.S. Leading Economic Index is not unusual when the economy is entering the mid-cycle of a recovery.

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

"The...massive flow disruptions in Japan are already beginning to turn. Commodity prices have come off the boil. Finally, both monetary and fiscal policy remains stimulative; even considering the finale of QE2 in a few weeks. The Fed has no intention of draining its balance sheet any time soon, nor raising rates.

Corporate America has rarely been healthier, and the cash firepower available to companies is massive. Debt-to-equity for US companies is at its lowest in over 20 years and they hold nearly $2 trillion in cash on their balance sheets.

With leverage so low, if it simply returned to the average of the past decade, companies would have an extra $2.7 trillion to spend, according to the Financial Times. Deal-making is back.

In sum, growth has certainly slowed, but many of the contributing factors are temporary in nature. Assuming US GDP growth can rebound back above 2%, historically this isn't a bad backdrop for stocks. Looking at all years when US GDP growth was between 2% and 3%, the average return for the S&P 500 was nearly 14%, with only two down years out of 11 total. Not bad (emphasis added)."

Disclosure: Long SCHW

Posted by

David Templeton, CFA

at

11:29 PM

0

comments

![]()

![]()

Labels: Economy , General Market