When I picked up the Wall Street Journal today and began to read Blame Television for the Bubble on the Opinion Page, I thought the editorial was going to be a parody on television and its contribution to creating the housing bubble. To my surprise, I was wrong.

The author of the editorial, Jim Sollisch, actually notes,

"...one culprit continues to get off scot-free: HGTV. The cable network HGTV is the real villain of the economic meltdown."

"HGTV is an evil empire that never rests. You can loathe your current domicile 24/7 with programs such as "Stagers" (move a few things around and double the value of your home); "Designed to Sell" (you can sell your house, even if the house next to yours is in foreclosure); "Design on a Dime" (see, it's cheap); and "Property Virgins" (losing your virginity was fun, wasn't it?) Every show features highly attractive hosts who show you how to "unlock the hidden potential" in your home, how to turn a $10 thrift-store table into a "wow" media center, and how to make everything "pop." Pop is the word of choice on HGTV."

(click to enlarge)

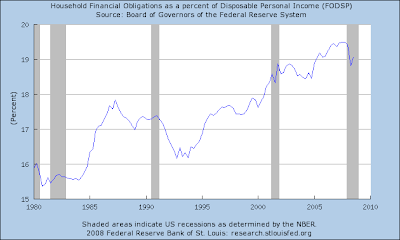

The increase in debt in and of itself is not necessarily bad; however, the below chart shows household debt as a percent of disposable personal income grew ever higher since the 1980's.

(click to enlarge)

Certainly some mortgage holders were duped by unscrupulous mortgage brokers. But I would say many real estate buyers thought they could buy more house than they could afford thinking real estate prices always increased. What happened to putting 20% down on a home? What happened to taking out a mortgage where the payments were affordable for the duration of the loan? I saw a 60 Minutes show recently that interviewed a doctor who purchased a number of homes in order to flip them. The doctor admitted not reading any of the loan documents saying she did not have time to do that since she was busy running her doctor practice.

Individuals need to learn to live within their means going forward. Placing the blame on a television show is an insult to ones intelligence.

Individuals need to learn to live within their means going forward. Placing the blame on a television show is an insult to ones intelligence.

Source:

Blame Television for the Bubble

The Wall Street Journal

By: Jim Sollisch

January 3-4, 2009

http://online.wsj.com/article/SB123094453377450603.html

No comments :

Post a Comment