Posted by

David Templeton, CFA

at

7:55 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

1:03 AM

0

comments

![]()

![]()

Labels: General Market

When the company's results revert back toward the mean, though, usually because cyclical firms often have little pricing power and their results are largely at the whim of uncontrollable market forces, management painfully discovers it has bitten off more than it can chew. Avoiding erratic earnings streams is step one for the dividend growth investor.

High or rising payout ratios: The same fat dividend that warms the heart of investors can sometimes give a company's management severe heartburn. Companies are loath to cut or suspend dividends even when that option, however ugly, is clearly the best move for the firm in the long haul. Managers know, with good reason, that dividend cuts and suspensions send the message that they do not think the firm will be able to maintain or continue growing earnings at a rate high enough to support their payout (emphasis added).

It should be no surprise, then, that management is often willing to feign confidence by continuing to raise their payouts in the face of slowing or flat earnings growth...

Decelerating dividend growth rates: The last quick check also happens to be the first long-range sign that a long-growing company could fall flat on its face. Investors should take note when a company that has grown its dividend at a hearty clip over a multi-year period suddenly yanks back the reins and reduces the size of its dividend hikes.

Now, there are plenty of reasons why such a move could make practical sense. The company could be shifting toward a policy of returning more money to investors through share repurchases, ramping up capital expenditures or research and development, or simply exhibiting prudent management.

While repurchases typically boost share prices, in the insurance industry, they're a sign that competition is pushing premiums low enough to threaten profit growth. Property and casualty stocks are lagging behind both life insurers and U.S. benchmarks as commercial insurance prices decline the most since they started falling in 2004.

The insurers buying stock wouldn't have to resort to repurchases if competitors weren't driving prices to potentially unprofitable levels, said Donald Light, an analyst at Celent LLC, a Boston-based financial research and consulting firm.

"Buybacks should limit price declines, but they're also a sign of falling prices,'' he said. "You don't think there's a lot of attractive new business when you're buying back your own shares."

Posted by

David Templeton, CFA

at

10:45 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

10:02 AM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

2:53 PM

0

comments

![]()

![]()

Labels: General Market

...Very simply, investors over the last few years have been looking for places to put money to work. Corporates haven’t been borrowing, and even governments have enjoyed improving budget balances and have had to borrow less. Forced to find a place to put their money to work, investors began to look to subprime borrowers - the individuals with either low income or bad credit or both - as a potential investment option. Banks would provide the cash for mortgage loans to subprime borrowers, and then they would bundle those loans up into one big package, sometimes called a pool, and then sell securities whose value was linked to the performance of the pool of mortgages. Investors could buy the securities and were effectively lending money to the subprime borrowers, with the banks serving as the middlemen.

The collapse has been due to something very simple: people lent money to borrowers who couldn’t pay it back. Now the process is beginning to snowball; subprime borrowers are defaulting, which puts homes on the market for a forced sale, which drags prices down, which makes it more difficult for other subprime borrowers to refinance their mortgages into loans with better terms, which then causes more defaults.

Posted by

David Templeton, CFA

at

8:36 PM

0

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

7:39 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

11:18 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

11:47 PM

0

comments

![]()

![]()

Labels: Dividend Return

Posted by

David Templeton, CFA

at

7:02 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

8:16 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

- Buybacks in 2006 totaled $432 billion.

- 56.8% of the 500 companies reduced their share count.

- Buybacks boosted EPS by at least 4% for more than 20% of the issues in 2006.

- Over the ten quarters between Q4 2004 and Q1 2007, S&P 500 issues spent $965 billion on buybacks, slightly less than the $1,010 billion spent on capital expenditures, and substantially more than the $534 billion paid in the form of common dividends.

- In 2006, S&P 500 companies spend more on buybacks ($432 billion) than the United States government spent on Medicare ($408 billion).

- S&P 500 treasury shares increased 19.7% in 2006.

- The market value of S&P 500 treasury shares is $590 billion higher than their balance sheet posting, and represents 12.4% of the current market value.

The availability of this discretionary liquid asset, cash and treasury shares, makes almost every company a potential growth issue and many a potential take-over target. What companies choose to do with this enormous asset is perhaps the most important decision facing them, and it could have long-lasting effects as to their profitability and market value for years to come...Buybacks, while adding to short-term returns, are temporary in nature if the shares are not retired - which they have not been. Cash build-ups that are now being used to supplement earnings via interest income and reduce share count are not a substitute for operating earning and, as such, should not be priced into future earnings or multiples.

Posted by

David Templeton, CFA

at

6:26 PM

0

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

12:12 PM

0

comments

![]()

![]()

Labels: Commodities , Investments

Posted by

David Templeton, CFA

at

9:15 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

10:32 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

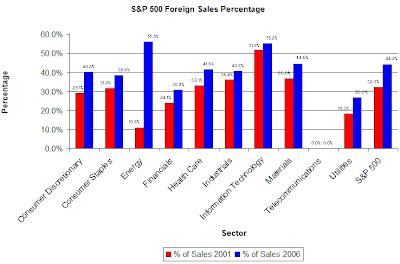

"The significant increase in foreign sales by U.S. companies over the past five years is due to the rapidly expanding foreign market for goods and services. We believe that the present trend will continue with greater portions of U.S. products being produced and sold abroad.”

Standard & Poor’s findings were based on fiscal year 2006 data for issues with full reporting information, representing 53.7% of the S&P 500’s market value. Standard & Poor’s also calculated that an additional 0.95% of sales was generated from U.S. produced goods and services that were exported abroad, down from the 1.14% reported in 2005.

Posted by

David Templeton, CFA

at

9:57 PM

0

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

10:35 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

10:10 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

11:08 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

7:05 PM

0

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

9:29 AM

0

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

11:28 PM

0

comments

![]()

![]()

Labels: Technicals

"The decline in dividend increases is disturbing, especially in light of continued, moderate earnings growth and the abundance of corporate cash. We believe the present wave of corporate buybacks is contributing to the slower pace of dividend growth in 2007."

Posted by

David Templeton, CFA

at

8:24 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

8:32 PM

0

comments

![]()

![]()

Labels: Dividend Return

Posted by

David Templeton, CFA

at

1:12 PM

0

comments

![]()

![]()

Labels: Financial Planning

More detailed information on this topic can be found by clicking the article's link noted below.

- How well does the adviser know your plan? Ideally the person should be familiar with or willing to learn about how your 401(k) works and the investment choices available.

- How will your adviser find the right investment mix for you? Smart asset allocation and consistent rebalancing are the main investing strategies that can make early retirement a reality.

- How closely will the adviser monitor your plan? Through the internet, 401(k) investors can keep an eye on their account daily if they so choose. Your adviser should be watching regularly, too, and sending you alerts if you need to rebalance or make other changes.

Posted by

David Templeton, CFA

at

11:52 AM

0

comments

![]()

![]()

Labels: Financial Planning