Posted by

David Templeton, CFA

at

4:11 PM

0

comments

![]()

![]()

Labels: General Market , Investments

|

Posted by

David Templeton, CFA

at

10:59 PM

1

comments

![]()

![]()

Labels: Economy , General Market

"Roubini states, so what is behind this massive rally? Certainly it has been helped by a wave of liquidity from near-zero interest rates and quantitative easing. But a more important factor fueling this asset bubble is the weakness of the US dollar, driven by the mother of all carry trades. The US dollar has become the major funding currency of carry trades as the Fed has kept interest rates on hold and is expected to do so for a long time. Investors who are shorting the US dollar to buy on a highly leveraged basis higher-yielding assets and other global assets are not just borrowing at zero interest rates in dollar terms; they are borrowing at very negative interest rates – as low as negative 10 or 20 per cent annualised – as the fall in the US dollar leads to massive capital gains on short dollar positions."

"The U.S. dollar has become a huge ‘carry trade’ vehicle for all risky assets. Historically, there is no correlation at all between the DXY index (the U.S. dollar index) and the S&P 500. In the past eight months, that correlation is 90%. Ditto for credit spreads — zero correlation from 1995 to 2008, but now it has surged to 90% since April. There was historically a 70% inverse correlation between the U.S. dollar and emerging markets, such as the Brazilian Bovespa, and that correlation has also increased to 90% since the spring. Even the VIX index, which historically has had no better than a 20% correlation with the U.S. dollar, has now sent that correlation surge to 90%. Amazing. The inverse correlations between the U.S. dollar and gold and the U.S. dollar and commodities were always strong, but these too have strengthened and now stand at over 90%."

|

"If a ‘speculative bubble' were driving equity prices higher, presumably volumes would reflect the exuberance,” Mr. Hatheway said. “Yet average daily trading volume on the New York Stock Exchange has been declining since 2005, reversing the strong trend growth over the previous decade."

There is one bubble that is worth noting, UBS suggested. As the price of gold has increased, so too has derivative volumes."

"There, soaring prices have coincided with an increase in derivatives volumes. That squares with our view that what is driving gold prices is not a supply-demand imbalance in the physical market, but rather an increase in financial demand, he said.

"Gold prices and derivatives activity, in other words, show signs of a market driven by financial demand, either for hedging or speculative purposes. But what's notable is that gold is unique – equity, credit and even government bond markets do not show evidence of a similar pick up in derivatives activity."

"we (UBS) believe price gains largely reflect improved fundamentals, including signs of global economic recovery, the strength of emerging economies, and a recovery of earnings. Financial market activity—including the size of the financial sector as well as funds flows and derivatives activity—remains subdued by historical standards."

"Until leverage resumes market outcomes will be driven mostly by growth and earnings expectations. Importantly, as well, uncertainty about monetary policy 'exit strategies' is likely to boost market volatility next year. And with many asset classes now close to 'fair value', risk-adjusted returns are likely to be lower in the year to come."

Posted by

David Templeton, CFA

at

5:06 PM

2

comments

![]()

![]()

Labels: Economy , General Market , International

Posted by

David Templeton, CFA

at

2:29 PM

0

comments

![]()

![]()

Labels: General Market , International

Posted by

David Templeton, CFA

at

10:22 PM

0

comments

![]()

![]()

Labels: Sentiment

|

|

Posted by

David Templeton, CFA

at

6:45 PM

0

comments

![]()

![]()

Labels: Technicals

- The estimated payout ratio will equal 48% based on 6/2010 estimated earnings of $1.89. This compares to the 5-year average payout ratio of approximately 53%.

- The company carries an S&P Earnings & Dividend Quality Ranking of A+.

|

|

Posted by

David Templeton, CFA

at

10:26 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

- The estimated payout ratio will equal 43% based on 12/2010 estimated earnings of $1.46. This compares to the 5-year average payout ratio of approximately 36%.

- The company carries an S&P Earnings & Dividend Quality Ranking of B+.

- The estimated payout ratio will equal 33% based on June 2010 estimated earnings of $3.68. The reported earnings for the year ending June 2009 equaled $3.18.

- The company has an S&P Dividend & Earnings Quality Ranking of B.

|

|

Posted by

David Templeton, CFA

at

9:46 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

|

Posted by

David Templeton, CFA

at

11:00 AM

0

comments

![]()

![]()

Labels: Sentiment

|

|

Posted by

David Templeton, CFA

at

10:09 AM

0

comments

![]()

![]()

Labels: Economy , General Market

|

| From Disciplined Approach to Investing |

Posted by

David Templeton, CFA

at

10:32 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

Posted by

David Templeton, CFA

at

1:44 PM

1

comments

![]()

![]()

Labels: Economy

Posted by

David Templeton, CFA

at

11:59 PM

1

comments

![]()

![]()

Labels: Investments

When looking at the 8-period moving average of the sentiment at 37.94%, the decline is not so significant though. In the February-March 2008 time frame, the 8-period average was in the mid 20% range for six weeks. Nonetheless, investors seem to be doubtful of future market advances. As this is a contrary indicator, it is one factor that suggests the market could advance further over the next six months. Today's 200 point or 2% advance on the Dow Jones Index is a good start.

When looking at the 8-period moving average of the sentiment at 37.94%, the decline is not so significant though. In the February-March 2008 time frame, the 8-period average was in the mid 20% range for six weeks. Nonetheless, investors seem to be doubtful of future market advances. As this is a contrary indicator, it is one factor that suggests the market could advance further over the next six months. Today's 200 point or 2% advance on the Dow Jones Index is a good start. |

Posted by

David Templeton, CFA

at

10:15 PM

0

comments

![]()

![]()

Labels: Sentiment

Posted by

David Templeton, CFA

at

7:44 PM

0

comments

![]()

![]()

Labels: Dividend Return

- From March 9th, the 165 trading days produced a 53.16% gain for the S&P 500, which is the best gain since the 53.76% increase in October 1938.

- While the market remains 33.80% off its 2007 high, the gains have mostly stayed with little profit taking and few major selling days.

- Volatility picked up during October and continues to remain higher than historical values, although lower than the first half of 2009. Year-to-date, there have now been more days where the S&P 500 moved less than 1% than more than 1%. However, the swings have also been fewer and less drastic. The last 5% move was on March 23rd (+7.08%), with the last 3% move occurring on June 22nd (-3.06%).

Posted by

David Templeton, CFA

at

9:26 PM

0

comments

![]()

![]()

Labels: Dividend Return

|

Posted by

David Templeton, CFA

at

11:52 PM

0

comments

![]()

![]()

Labels: Technicals

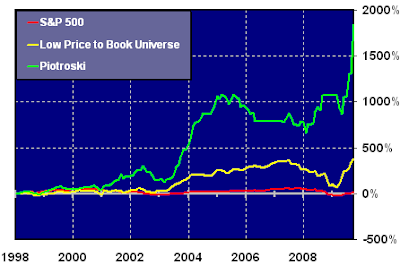

Of late the number of companies passing the screen's criteria has been slim to none. The criteria of the screen are:

Of late the number of companies passing the screen's criteria has been slim to none. The criteria of the screen are:

- The price-to-book ratio ranks in the lowest 20% of the entire Stock Investor AAII database.

- The stock does not trade on the over-the-counter exchange.

- The return on assets for the last fiscal year (Y1) is positive.

- Cash from operations for the last fiscal year (Y1) is positive.

- The return on assets ratio for the last fiscal year (Y1) is greater than the return on assets ratio for the fiscal year two years ago (Y2).

- Cash from operations for the last fiscal year (Y1) is greater than income after taxes for the last fiscal year (Y1).

- The long-term debt to assets ratio for the last fiscal year (Y1) is less than the long-term debt to assets ratio for the fiscal year two years ago (Y2).

- The current ratio for the last fiscal year (Y1) is greater than the current ratio for the fiscal year two years ago (Y2).

- The average shares outstanding for the last fiscal year (Y1) is less than or equal to the average number of shares outstanding for the fiscal year two years ago (Y2).

- The gross margin for the last fiscal year (Y1) is greater than the gross margin for the fiscal year two years ago (Y2)

- The asset turnover for the last fiscal year (Y1) is greater than the asset turnover for the fiscal year two years ago (Y2).

Investors are highly encouraged to fully research any company mentioned before purchasing. In the case of HIHO, it is a small company trading at a stock price below $5 per share. The stock's market capitalization is $6.1 million. These below $5 stocks are typically very volatile investments.

Investors are highly encouraged to fully research any company mentioned before purchasing. In the case of HIHO, it is a small company trading at a stock price below $5 per share. The stock's market capitalization is $6.1 million. These below $5 stocks are typically very volatile investments.

Posted by

David Templeton, CFA

at

11:44 AM

0

comments

![]()

![]()

Labels: Investments , Valuation

"The error of optimism dies in the crisis but in dying it ‘gives birth to an error of pessimism. This new error is born, not an infant, but a giant; for (the) boom has necessarily been a period of strong emotional excitement, and an excited man passes from one form of excitement to another more rapidly than he passes to quiescence.’"

Posted by

David Templeton, CFA

at

9:01 AM

0

comments

![]()

![]()

Labels: Economy , General Market