Monday, December 31, 2012

Thank You To Our Clients, Prospects And Readers Of Our Content

Posted by

David Templeton, CFA

at

4:18 PM

0

comments

![]()

![]()

Labels: General Market

Volumes Near Ten Year Low

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:19 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

Sunday, December 30, 2012

Dividend Strategies Underperform In 2012

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:21 PM

0

comments

![]()

![]()

Labels: Dividend Return , General Market

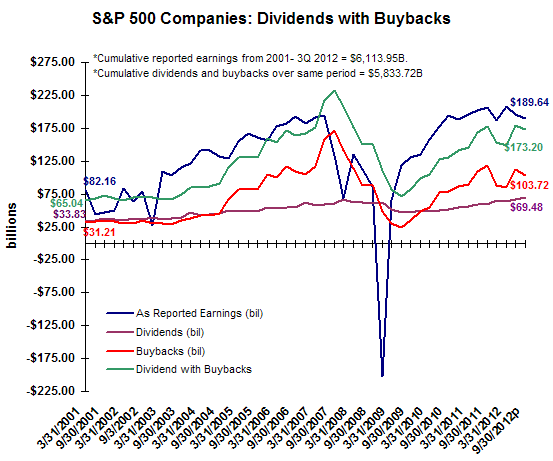

Dividend Growth More Consistent Than Buybacks In Q3 2012

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

2:18 PM

0

comments

![]()

![]()

Labels: Dividend Analysis , General Market

Saturday, December 29, 2012

A Look At The Top 1% Of Taxpayers, Government Revenues/Expenses And The Deficit

|

| From The Blog of HORAN Capital Advisors |

- "the 1.35 million taxpayers that represent the highest-earning one percent of the Americans who filed federal income tax returns in 2010 earned 18.9% of the total gross income and paid 37.4% of all federal income taxes paid in that year."

- "the 128.3 million taxpayers in the bottom 95% of all U.S. taxpayers in 2010 earned 66.2% of gross income and that group paid 40.9% of all taxes paid."

- "in other words, the top 1 percent (1.35 million) of American taxpayers paid almost as much federal income tax in 2010 ($354.8 billion) as the entire bottom 95% of American tax filers ($388.4 billion)."

- "about half (58 million) of the bottom 95% of American “taxpayers” paid nothing or got a tax refund."

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

2:34 PM

0

comments

![]()

![]()

Labels: Economy

Wednesday, December 26, 2012

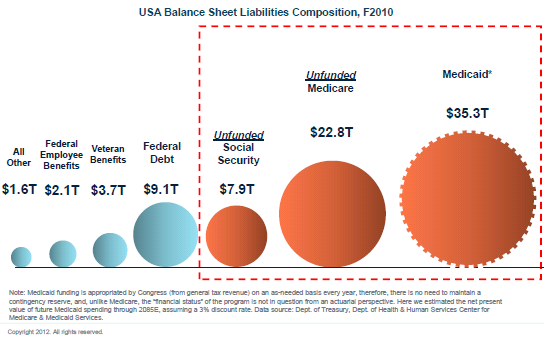

A Need To Focus On Government Outlays

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:15 PM

0

comments

![]()

![]()

Labels: Economy

Saturday, December 22, 2012

Fiscal Cliff Not Resulting In Dividend Cliff

Interestingly, this potentially higher tax rate does not seem to be having a "negative" impact on the long term dividend policy for companies. Factset Research notes in their Dividend Quarterly report for Q3:

- aggregate dividends per share (“DPS”) grew 15.5% year-over-year at the end of Q3.

- the number of companies paying a dividend in the trailing twelve-month period again surpassed 400 (80% of the S&P 500 index).

- the S&P 500 also hasn’t shown a slowdown in companies initiating dividend payments. In Q3, 3.0% of non-payers “initiated” dividends, which is nearly triple the average over ten years (1.2%).

- the aggregate dividend payout ratio is 2.0% below the ten-year median, it is at its highest level (29.1% at the end of Q3) since the recession (when payout ratios were distorted by low aggregate earnings during the recession...).

- while there have been a number of companies that are signaling short-term changes in dividend policy or a shift towards more share buybacks..., a majority of companies have not yet responded, including the top ten dividend-payers in the S&P 500.

- the aggregate, forward twelve-month DPS estimate for the S&P 500 was 10% above the actual trailing twelve-month (“TTM”) payout at the end of November, which is a premium that is well above the ten-year average of 3%... Also, even when excluding the periods during the financial crisis (when forward DPS estimates fell below trailing figures), the forward consensus premium is in-line with the stabilized average starting in 2011.

Source:

Factset Dividend Quarterly (PDF)

By: Michael Amenta, Research Analyst

Facset Research

December 19, 2012

http://www.factset.com/websitefiles/PDFs/dividend/dividend_12.19.12

Factset Buyback Quarterly (PDF)

By: Michael Amenta, Research Analyst

Facset Research

December 20, 2012

http://www.factset.com/websitefiles/PDFs/buyback/buyback_12.20.12

Posted by

David Templeton, CFA

at

2:17 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Sunday, December 16, 2012

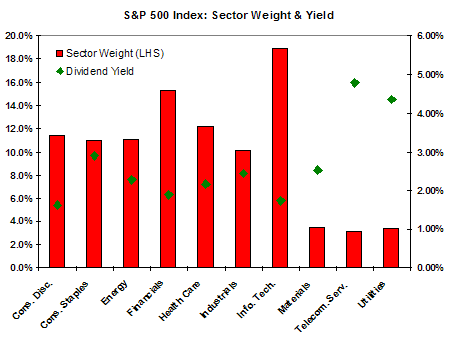

Technology Sector Largest Contributor To S&P 500 Yield

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Data Source: Standard & Poor's

Posted by

David Templeton, CFA

at

11:24 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Monday, December 10, 2012

The Arithmetic Of Equities

"Basically I am a bond guy. I like fat coupons. And I like return of principal. But I take my bonds where I can find them. And these days the place to find fat coupons and return of principal is among blue chip equities."

h/t: Market Folly

Posted by

David Templeton, CFA

at

9:26 AM

0

comments

![]()

![]()

Labels: General Market , Valuation

Another Record In Food Stamp Usage

Posted by

David Templeton, CFA

at

3:00 AM

0

comments

![]()

![]()

Labels: Economy

Sunday, December 09, 2012

Fiscal Cliff Creating A Spike In Extra Dividends

Posted by

David Templeton, CFA

at

6:28 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Saturday, December 08, 2012

Not So Golden Retirement Years Is Fallout From Weak Friday Employment Report

- those not in the labor force rose 542,000

- the civilian labor force fell by 350,000

- the number of employed declined 122,000

- discouraged workers rose 166,000, and

- the participation rate fell two tenths of a percent to 63.6%

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:50 PM

0

comments

![]()

![]()

Labels: Economy

Sunday, December 02, 2012

Implications Of An Elevated Equity Risk Premium For Asset Allocation

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:28 PM

0

comments

![]()

![]()

Labels: Asset Allocation , Economy , General Market

Saturday, December 01, 2012

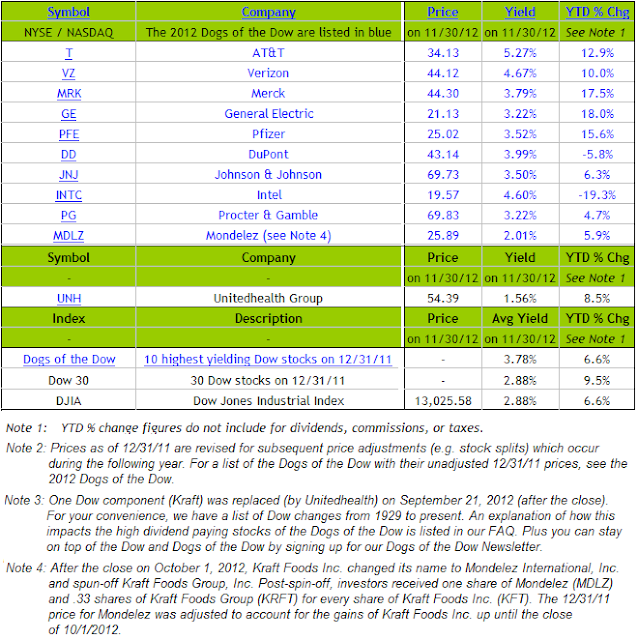

Dogs Of The Dow Performance Update

Posted by

David Templeton, CFA

at

6:33 PM

0

comments

![]()

![]()

Labels: Investments

Sunday, November 25, 2012

Retailers Open Thanksgiving To Counteract E-commerce Sales

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Source:

Black Friday Billion: Kick-Off to Brick-and-Mortar Shopping Season

Surges Past $1 Billion in E-Commerce Spending for the First Time

comScore

November 25, 2012

http://tinyurl.com/cn9xhhf

Posted by

David Templeton, CFA

at

3:59 PM

0

comments

![]()

![]()

Saturday, November 24, 2012

A Buyback Strategy Does Outperform

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:37 AM

0

comments

![]()

![]()

Labels: General Market

Friday, November 23, 2012

The Challenge: Finding A Balanced Solution To The Fiscal Cliff

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

H/T: The thoughts behind a portion of this article were gleaned from an article on Zero Hedge.

Posted by

David Templeton, CFA

at

5:28 PM

0

comments

![]()

![]()

Labels: Economy , General Market

Thursday, November 22, 2012

U. S. Government Spending Growth Nearly Always Positive (Updated)

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:24 AM

0

comments

![]()

![]()

Labels: Economy

Sunday, November 18, 2012

New Healthcare Law: Higher Employee Turnover And Reduced Company Stock Returns?

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

8:27 PM

0

comments

![]()

![]()

Labels: General Market

Many Believe Market Is Oversold So What Will Happen

- Don't Jump Off The Fiscal Cliff - Forbes

- Market Rally Soon? - Extreme Oversold Levels - MTR Investors Group

- 23 of 30 Dow Stocks Oversold - Bespoke Investment Group

- Use Dip To Buy Global Growth Stocks - Deutsche Bank's David Bianco

- Case Closed Dow Ends 2012 Near 13,500 - Zenpenny

- Dow Could Jump 1,000 Points on Fiscal Cliff Deal - Jeremy Siegel

|

| From The Blog of HORAN Capital Advisors |

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

2:26 PM

0

comments

![]()

![]()

Labels: Economy , General Market , Technicals

Monday, November 12, 2012

Fiscal Cliff Tax Impact By State

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:04 PM

0

comments

![]()

![]()

Labels: Economy

Equity Put/Call Ratio On The Rise

"The equity P/C ratio tends to measure the sentiment of the individual investor by dividing put volume by call volume. At the extremes, this particular measure is a contrarian one; hence, P/C ratios above 1.0 signal overly bearish sentiment from the individual investor. This indicator's average over the last 5-years is approximately .7, indicating the individual investor has been generally mostly bullish and more active on the call volume side"

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

2:51 PM

0

comments

![]()

![]()

Labels: Technicals

Saturday, November 10, 2012

QE3 Not Positive For "Risk On" Asset Class Performance

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:58 AM

0

comments

![]()

![]()

Labels: Economy , General Market

Thursday, November 08, 2012

Recession Risk Rising

|

| From The Blog of HORAN Capital Advisors |

As noted in the post, The Reformed Broker's Joshua Brown states:

"Do you see the percentages on the left side of the chart? 20% is the line in the sand. We've never hit that level and NOT had a recession. In 2006 we got close (18%?) but that particular Great Recession would be a year and half in the making. Note that we're back at that 20% line again. And I can't think of anything that keeps the leading indicators from going through it to the upside - the Fiscal Cliff stuff could only speed its ascent"

H/T: Political Calculations

Posted by

David Templeton, CFA

at

9:31 AM

0

comments

![]()

![]()

Labels: Economy

Wednesday, November 07, 2012

Election Is Over But More Uncertainty Ahead

- Mohamed El-Erian: Congratulations, Mr. President. Here's how to fix the economy.

- Kiplinger Magazine: 7 Priorities for Obama's Second Term

- CNBC: Economists' advice for Obama: Avoid 'fiscal cliff'

Posted by

David Templeton, CFA

at

11:05 PM

0

comments

![]()

![]()

Labels: Economy , General Market

Saturday, November 03, 2012

Job Creation Versus Growth In Food Stamp Rolls

|

| From The Blog of HORAN Capital Advisors |

As noted in a recent Weekly Standard article:

- "In January 2009, there were 133.56 million Americans with jobs and 31.98 million on food stamps. Today, there are 133.76 million Americans with jobs and 46.68 million on food stamps. The employment rolls have thus grown by 0.15 percent and the food stamp rolls have grown by 46 percent, meaning that for every one American who found a job, 75 Americans signed up for food stamps.

- Total spending on food stamps is now more than $80 billion annually, a fourfold increase from 2001. Total spending on federal means-tested welfare—food stamps, public housing, social services, cash aid, etc.—is now approximately $1 trillion. That amount is enough, if converted to cash, to send every household beneath the federal poverty line an annual check for $60,000."

Posted by

David Templeton, CFA

at

11:50 AM

0

comments

![]()

![]()

Labels: Economy

Thursday, November 01, 2012

U.S. Federal Budget At Critical Juncture

- Expenses exceed revenue.

- Unfunded liabilities.

|

| From The Blog of HORAN Capital Advisors |

- Percentage of tax payers versus those receiving government benefits.

|

| From The Blog of HORAN Capital Advisors |

The entire USA, Inc presentation is a worthwhile and eyeopening read.

h/t: Dealbook: New York Times

Posted by

David Templeton, CFA

at

10:51 AM

0

comments

![]()

![]()

Labels: Economy , General Market

Sunday, October 28, 2012

Apple: Anticipated Future Price Action

"10-28-12: The best case scenario with AAPL going forward is a period of sideways chop. Those highs at $700 won't be challenged for some time. The low created on Friday will likely be broken within the next few weeks, following a move up to $630 - $640 to convince the convincible that the iPhone 6 & 7 mean a $1,000 stock price in the near future.

The path that AAPL is likely to take has been revealed in the not to distant past. Check out box A. A high volume reversal that resulted in a gap and eventual failure.

While I don't expect a gap up here, I expect a retrace of a portion of the recent losses that should give AAPL enough new blood to make heads roll in the weeks ahead.

$520 - $550 remain the likely target for a solid buy point."

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:39 PM

0

comments

![]()

![]()

Labels: Technicals

HORAN Begins Financial Planning Blog

A few days ago, HORAN's Director of Financial Planning, Michael Napier, joined the blogosphere by starting HORAN's financial planning blog. As Michael notes in his initial post,

"Everybody blogs. In fact, it is estimated that close to 44 million blogs are created each year. Doing the math, that is nearly one new blog per second! So why am I jumping into the blogosphere? To help you get one step closer to achieving your financial goals in easy-to-understand language.

Two of the biggest challenges facing Americans today are access to great health care and the discipline to sustain wealth management strategies such as making smart decisions about investing and wealth transfer. My focus will primarily be sharing topics I come across on a daily basis to help your financial life. Strategies in tax- savings, estate planning, college savings, budgeting, insurance and retirement will be discussed."

- A Little- Known Financial Planning Strategy

- Financial Planning Must Do: Check and Double-Check Your Beneficiary Designations

The RSS Feed for all of the HORAN blogs can be found here: HORAN RSS Blog Feed

Posted by

David Templeton, CFA

at

12:44 PM

0

comments

![]()

![]()

Labels: Financial Planning

P/E Level For S&P 500 Index At Level Not Seen Since 1990s

"[The] chart illustrates the price to earnings ratio (PE ratio) from 1900 to present. Generally speaking, when the PE ratio is high, stocks are considered to be expensive. When the PE ratio is low, stocks are considered to be inexpensive. From 1900 into the mid-1990s, the PE ratio tended to peak in the low to mid-20s (red line) and trough somewhere around seven (green line). The price investors were willing to pay for a dollar of earnings increased during the dot-com boom (late 1990s), surged even higher during the dot-com bust (early 2000s), and spiked to extraordinary levels during the financial crisis (late 2000s). Since the early 2000s, the PE ratio has been trending lower with the very significant but relatively brief exception that was the financial crisis. More recently, the PE ratio has moved slightly higher. It is worth noting, however, that even with this recent uptick, the PE ratio still remains at a level not often seen since 1990."

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:00 AM

0

comments

![]()

![]()

Labels: General Market