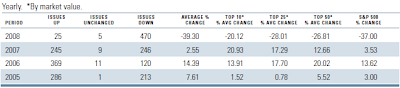

Not only was the return for the S&P 500 Index in 2008 the worst since 1937, but 2008 marked the worst dividend year since Standard & Poor's began tracking dividends in 1956. First, for performance, only 25 company issues in the S&P 500 Index generated a positive return in 2008. In 2007, 245 company issues had a positive return. A breakdown on some of the return characteristics is detailed in the below table.

(click to enlarge)

In regards to dividends, for the month of December,

In regards to dividends, for the month of December,The below table shows positive dividend actions have been on a steady downward trend since 2005.

- S&P notes the decreases continue to increase and increases continue to decline.

- The last three months of 2008 were the worst months in the Index's history with 288 decrease versus 52 decreases in 2007.

(click to enlarge)

Source:

Source:Market Attributes Snapshot (PDF)

Standard & Poor's

By: Howard Silverblatt, Senior Index Analyst

December 2008

http://www2.standardandpoors.com/spf/pdf/index/2009_1_SP500.pdf

No comments :

Post a Comment