Let me first start by saying I am a firm believer the foundation of ones equity investments should be in high quality dividend growth stocks. The attractiveness of these high quality dividend payers is they generate more consistent returns over time. In down markets especially, the dividend growers tend to hold up better than other equity investments.

Not surprisingly then, after the dismal equity market in 2008, a majority of investment strategist indicate investors should now focus their investment efforts on these dividend payers. Strategist find this to be a palatable recommendation since it "was" the dividend growth stocks that generated better returns in the latter part of the last bull market cycle. A similar line of thinking occurred in 2002 when strategists recommended buying technology stocks as they had fallen significantly from their early 2000 highs. Well it wasn't technology that worked in that subsequent cycle, it was energy and materials. Investment advice also follows a similar path when it comes to asset allocation recommendations.

The mantra in 2006 and 2007 was for investors to allocate investments across all equity styles, i.e., large cap, mid cap, small cap, international, etc. This type of recommendation was an easy sell to investors as 2003, 2004 and 2005 saw the rising equity markets lift nearly all markets. The end result in 2008 of this broad diversification among the equity styles was a greater loss of investor capital. It so happens that in down markets, equity correlations tend to move closer to 1. I discussed this topic in a post I wrote in November 2008 titled, Diversification Not Working in this Cycle. So what does this mean going forward?

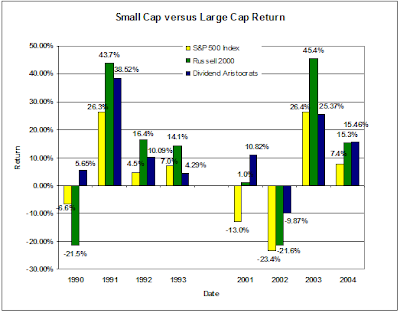

Investors should keep in mind that what worked in the last bull market cycle is unlikely to work in the next bull market. As the below chart shows, after the 2001-2003 recession, it wasn't the S&P 500 Index (large cap stocks) that outperformed. It was small cap (Russell 2000 Index) as well as dividend paying stocks (S&P's Dividend Aristocrats) that generated the better returns. The S&P 500 Index lagged other investment styles due to the higher concentration of technology stocks in the index at that time and the technology sector's inability to keep pace with the other sectors. How many advisers were recommending energy and material stocks? A similar outcome occurred coming out of the 1990-1991 recession.

Not surprisingly then, after the dismal equity market in 2008, a majority of investment strategist indicate investors should now focus their investment efforts on these dividend payers. Strategist find this to be a palatable recommendation since it "was" the dividend growth stocks that generated better returns in the latter part of the last bull market cycle. A similar line of thinking occurred in 2002 when strategists recommended buying technology stocks as they had fallen significantly from their early 2000 highs. Well it wasn't technology that worked in that subsequent cycle, it was energy and materials. Investment advice also follows a similar path when it comes to asset allocation recommendations.

The mantra in 2006 and 2007 was for investors to allocate investments across all equity styles, i.e., large cap, mid cap, small cap, international, etc. This type of recommendation was an easy sell to investors as 2003, 2004 and 2005 saw the rising equity markets lift nearly all markets. The end result in 2008 of this broad diversification among the equity styles was a greater loss of investor capital. It so happens that in down markets, equity correlations tend to move closer to 1. I discussed this topic in a post I wrote in November 2008 titled, Diversification Not Working in this Cycle. So what does this mean going forward?

Investors should keep in mind that what worked in the last bull market cycle is unlikely to work in the next bull market. As the below chart shows, after the 2001-2003 recession, it wasn't the S&P 500 Index (large cap stocks) that outperformed. It was small cap (Russell 2000 Index) as well as dividend paying stocks (S&P's Dividend Aristocrats) that generated the better returns. The S&P 500 Index lagged other investment styles due to the higher concentration of technology stocks in the index at that time and the technology sector's inability to keep pace with the other sectors. How many advisers were recommending energy and material stocks? A similar outcome occurred coming out of the 1990-1991 recession.

(click to enlarge)

So going forward, when the market exits its current slumber, investors should keep in mind what investment styles perform the best coming out of a recession and not just what worked late in the last cycle. If an investor builds the foundation of their equity portfolio in large cap dividend growth stocks, they can then add incremental exposures to the more volatile sectors like small cap. Historically, small cap stocks do perform well early in an economic recovery.

No comments :

Post a Comment