|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

12:37 PM

0

comments

![]()

![]()

Labels: Economy , General Market

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

4:44 PM

0

comments

![]()

![]()

Labels: General Market , International

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:02 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:42 PM

1

comments

![]()

![]()

Labels: Bond Market , Economy , General Market

The improvement in the unemployment rate earlier this month was certainly positive on the surface. The rate declined to 8.6% from the previously reported 9%. The improvement though came largely from the 300,000 individuals that simply stopped looking for a job. As a result, these additional people are not counted among the unemployed. As the below chart shows, the number individuals not in the labor continues to rise.

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:08 AM

0

comments

![]()

![]()

Labels: Economy

- Year-to-date (YTD) dividend payers in the S&P 500 have returned 1.72%, compared to the non-payers loss of 4.63%.

- The actual dividend payment YTD is up 16.2%.

- The indicated dividend rate (based on the current rate) is up 16.8% YTD, but still off 4.9% from the June 2008 high.

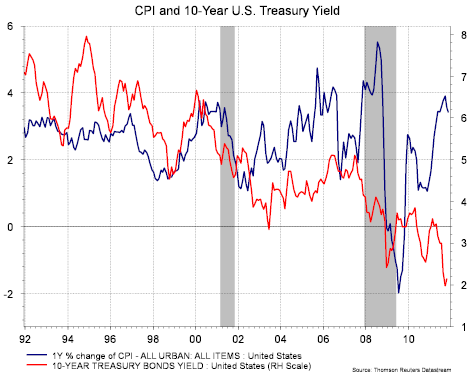

- From 1995 the S&P 500 indicated dividend yield has averaged 43% of the U.S. 10-year Treasury note, the current rate is 105%.

- 215 issues have a current yield higher than the 10-year Treasury.

Posted by

David Templeton, CFA

at

6:13 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:50 PM

0

comments

![]()

![]()

Labels: Economy

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

7:12 PM

0

comments

![]()

![]()

Labels: Economy

“the LEI is pointing to continued growth this winter, possibly even gaining a little momentum by spring. The lack of confidence has been the biggest obstacle in generating forward momentum, domestically or globally. As long as it lasts, there is a glimmer of hope.”

|

| From The Blog of HORAN Capital Advisors |

- Industrial production rose 0.7% in October

- Chicago PMI rose to 62.6 from 58.4, a seven-month high, and the new orders component rose to its highest level since March at 70.2

- The Institute for Supply Management’s (ISM) Manufacturing Index rose to 52.7, the highest level since June

- New orders increased to 56.7 from 52.4

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:32 PM

0

comments

![]()

![]()

Labels: Economy , General Market , International

“the problems in the eurozone are nothing new: too much debt from eurozone member countries to over-leveraged European financial institutions. Adding to the woes is the lack of global competitiveness among many of the zone's members, thanks to the tying of 17 vastly different economies and policies to one (too-strong) currency. The lack of a single fiscal authority within the eurozone that's capable of enforcement or supervision has allowed the problems to fester and the can to be continually kicked down the road (emphasis added).”

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:31 PM

0

comments

![]()

![]()

Labels: Economy , General Market

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

1:49 PM

1

comments

![]()

![]()

Labels: Sentiment

"The most unfortunate difference between then and now is that the euro, unlike the gold standard, is a raccoon trap: Its designers deliberately left out an exit procedure. That means you can get in, but you can’t get out without leaving a part of yourself behind. Eichengreen points out that Britain was growing again by the end of 1932, just over a year after abandoning gold under duress. Today a country—say, Greece—that quit the euro would take far longer to right itself. That’s because unlike Britain, to get relief Greece would have to default on its euro-denominated debts and damage its credit rating. "The Greek government," Eichengreen says, 'will be hard-pressed to find funds to recapitalize the banking system. Greek companies won’t be able to get credit lines. The new Greek government is going to have to print money hand over fist. At some point they would be able to push down the drachma and become more competitive. But the balance is different now.'"

Posted by

David Templeton, CFA

at

11:51 AM

0

comments

![]()

![]()

Labels: Economy , International

Posted by

David Templeton, CFA

at

9:33 AM

0

comments

![]()

![]()

Labels: General Market

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

2:54 PM

0

comments

![]()

![]()

Labels: Technicals

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:54 PM

0

comments

![]()

![]()

Labels: Economy

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:25 PM

0

comments

![]()

![]()

Labels: Dividend Analysis , Dividend Return

For the third quarter of 2011, 454 companies in the S&P 500 have reported results with 70% reporting earnings above expectations. The estimated earnings growth rate for Q3 is 17.7% according to Thomson Reuters.

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:19 PM

0

comments

![]()

![]()

Labels: General Market

Much of the volatility impacting global markets of late is the result of the European sovereign debt issues. Italy is the latest country to see its bond rates soar.

Much of the volatility impacting global markets of late is the result of the European sovereign debt issues. Italy is the latest country to see its bond rates soar. |

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

"...the debt problems facing advanced economies are even worse than we thought. Given the benefits that governments have promised to their populations, ageing will sharply raise public debt to much higher levels in the next few decades. At the same time, ageing may reduce future growth and may also raise interest rates, further undermining debt sustainability. So, as public debt rises and populations age, growth will fall. As growth falls, debt rises even more, reinforcing the downward impact on an already low growth rate. The only possible conclusion is that advanced countries with high debt must act quickly and decisively to address their looming fiscal problems. The longer they wait, the bigger the negative impact will be on growth, and the harder it will be to adjust."

Posted by

David Templeton, CFA

at

5:05 PM

0

comments

![]()

![]()

Labels: Economy , International

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:38 AM

0

comments

![]()

![]()

Labels: Economy

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

7:48 PM

0

comments

![]()

![]()

Labels: Economy , General Market

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

4:16 PM

0

comments

![]()

![]()

Labels: International

Posted by

David Templeton, CFA

at

11:22 PM

0

comments

![]()

![]()

Labels: Newsletter

This evening I had a conversation with an individual whose career is working as an economist. The discussion topic focused on taxes and the deficit. He was adamant that the risk for the U.S. was centered around the "law of large numbers" as it relates to this countries debt level.

This brought to mind the article post written by Terry Horan, the CEO of our business partner firm HORAN Associates, on his blog today, Parties in the Park and Dancing in the Dark. In his post he discusses the 99 Percenters argument that they believe the system is rigged, they are not getting a fair shake and it is time for change.

In Terry's post he shows the below table of federal tax receipts, spending and the government deficit, which was d

Also reported by the Wall Street Journal, "revenue rose 6.5% billion to $2.3 trillion, the equivalent of 15.4% of gross domestic product, largely due to higher income-tax receipts in fiscal 2011, the Treasury said. Spending climbed 4.2% to $3.6 trillion, or 24.1% of GDP, largely due to higher spending on interest, Medicare and Social Security. Thirty six cents of every dollar spent by the federal government in fiscal 2011 was borrowed (emphasis added).

The fallacy of showing the deficit as a percentage of GDP is, at some point, the debt grows to a level where it can't be repaid within any reasonable time if at all. Or, in looking at Greece, there are no buyers of the debt. For the U.S., it's buyer is China.

What makes the discussion about our $14 trillion debt difficult for the average person to comprehend is the absolute size of the number where billions and trillions simply do not seem like real numbers--the "law of large numbers". A recent article at the American Thinker website, The National Debt is Beyond Our Comprehension, attempts to put the amount into perspective.

"We can probably get our minds around a million dollars, but beyond that the numbers become mere abstractions. They simply cease to be real. They are not real, because we really cannot visualize them in a meaningful way. We may have gotten used to hearing about billions, but trillions are really beyond our mental grasp. How many of us, for example, can state the number of zeros in a trillion without having to count them? There are twelve. Now try to mentally visualize the number one trillion. Can you do it? Can you really see a "1" followed by twelve zeros in your mind? I can visualize a billion, but that is only nine zeros: three groups of three. It takes some effort to mentally see four groups of three zeros.

Suppose someone was going to give you $1 every second of every minute, of every hour, of every day without stopping. How long would it take them to give you $1 trillion? Well, let's see. There are 60 seconds in a minute, so that is $60 every minute. Then there are 60 minutes in every hour, so that means we would receive $3,600 every hour. Wow! Even my plumber doesn't charge that much. In a single day, therefore, you would receive $86,400. Most people don't get that much in a year.

Since there are 365¼ days in a year, at the rate of $1 per second the pile of dollar bills would amount to only $31,557,600. Now we are talking real money. That is a lottery jackpot most of us would love to win. But that is still just a number in the low millions.

So, at a dollar a second how long would we have to wait before we could see the pile grow to $1 trillion? Are you ready for the answer? Drum roll, please. It would take over 31,688 years. Even at $10 per second they would still have to have started handing you the money more than a thousand years before the birth of Christ! And even at $100 per second none of us could live long enough to get it all.

At $100 per second we are still only talking about $8,640,000 a day. So in a year you would have accumulated only a little over $3 billion. It will take more than 316 years to reach $1 trillion.

A trillion dollars is so much money that you and I would probably not be able to spend that much for ourselves unless we bought a small country somewhere. Most of us would have trouble trying to spend a billion dollars, and a trillion is a thousand billion. So, if the government wants to reduce the deficit by a trillion dollars, it would have to do the equivalent of cutting a billion dollars from each of one thousand government programs...

The frightening truth is that Congress cannot easily cut $1 trillion from the deficit. The reality is that if you gave a new congressman on his first day on the job a copy of the budget, and told him to cut $10,000 from the budget every second of every day nonstop, his term in Congress would be up before he had cut out $1 trillion."

Posted by

David Templeton, CFA

at

10:48 PM

0

comments

![]()

![]()

Labels: Economy

"At this point, companies are continuing to use buybacks to prevent earnings dilution from employee options, as well as shares used for dividend reinvestment programs. Few companies are venturing outside of the box to purchase additional shares, as was the common practice from late 2005 through mid-2007."

"Exxon Mobil's buybacks have reduced its share count by 18.5% over the past five years ($129 billion), which may cost it its position as the largest company in the world."

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:28 PM

1

comments

![]()

![]()

Labels: Dividend Analysis

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

2:39 PM

0

comments

![]()

![]()

Labels: Investments