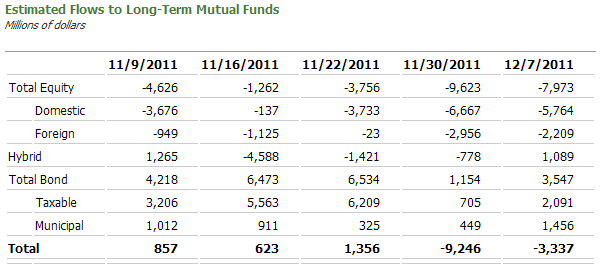

Recent mutual fund flow data shows investors continue to favor bonds over equities.

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Source: ICI

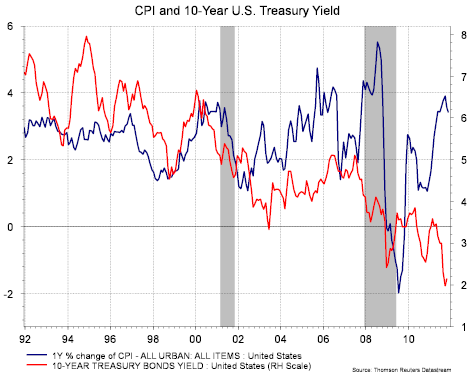

With the sovereign debt issues in Europe top of mind for investors, they continue to bet the best of the worst fixed income investments are U.S. Treasuries. One risk investors face with fixed income investments is the negative impact of a rise in rates. The 10-year U.S. Treasury yield is a meager 1.85% in spite of the fact the consumer price index is running at a year over year rate of 3.4%. Investors are in for a rude awakening when rates do begin to move higher (bond prices have an inverse relationship to the move in interest rates).

|

| From The Blog of HORAN Capital Advisors |

1 comment :

I don't favor bond funds. In general I am not very positive on bond funds. And especially with such low interest rates I am not. To pick up some income generating investments I would increase dividend paying stocks (especially those with good likelihood to increase dividends going forward, such as the dividend aristocrats you mentioned a few days ago).

Post a Comment