Inflation has not been a threat to the economy or to asset prices in 2010. In fact, last week's CPI report contained hints of deflation with the seasonally adjusted CPI for May equal to the CPI reported in December. However, James Hamilton, professor of economics at the University of California San Diego notes in a recent article on inflation versus deflation,

"...my concern about long-run inflation comes not from the expansion of the Fed's balance sheet, but instead from worries about the ability of the U.S. government to fund its fiscal expenditures and debt-servicing obligations as we get another 5 or 10 years down the current path"

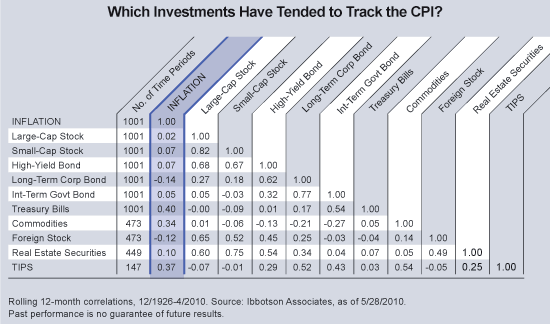

In the event inflation does take hold, what investments should an investor pursue to protect their assets? To answer that question an investor should determine whether they want to pursue an inflation hedge strategy or whether they desire an inflation protection strategy. The difference between an inflation hedge versus an inflation strategy is best summed up by Bill Ralls, CFA of Fidelity.

"In theory, a perfect inflation hedge would be an investment whose price moves in the same direction, at the same time, and by the same amount as changes in the consumer price index. Of course, there is no perfect inflation hedge, and while past performance is no guarantee of future success, some asset types have been more successful than others. For a successful hedging strategy, an investment’s return should increase at least as much as and at about the same time as the increase in inflation—or the time lag should at least be measured in months rather than years. Whereas building in protection against inflation over the long haul requires a more holistic approach and a consideration of what asset types have tended to do best in different inflationary environments."

|

Although commodities have one of the higher correlations, in periods of low inflation (Quintile 1 in the below table) the average 12-month rolling return for commodities is actually negative for all the rolling periods and commodities generated negative returns in 49% of the 12-month rolling periods evaluated.

|

In high inflation environments, Quitiles 4 & 5 above, commodities had the best 12-month rolling returns. Given the volatile nature of commodity prices, they still generated negative returns in 16% and 28% of the rolling periods.

As I noted in an article from a few years ago, Are Stocks A Good Hedge Against Inflation?, the important factor to consider is the direction of inflation. If the rate of inflation is slowing, i.e., increasing at a decreasing rate, the market is likely to view this as a positive for stocks. So in a high inflation environment, even stocks can be a good investment if the rate of change in inflation is negative.

The conclusion in my earlier article noted, "in these tough times in the market, stock price returns will be impacted by events happening in the future and not by those that have already occurred. From an emotional standpoint, it is easy to let ones feelings for future stock expectations get clouded by past events. Being able to overcome these past influences is important in achieving positive investment returns."

Source:

Inflation vs. deflation: Prepare for Either

Fidelity Viewpoints

By: Bill Ralls, CFA

June 2, 2010

https://news.fidelity.com/news/article.jhtml?guid=/FidelityNewsPage/pages/fidelity-prepare-for-inflation-or-deflation&topic=investing

As I noted in an article from a few years ago, Are Stocks A Good Hedge Against Inflation?, the important factor to consider is the direction of inflation. If the rate of inflation is slowing, i.e., increasing at a decreasing rate, the market is likely to view this as a positive for stocks. So in a high inflation environment, even stocks can be a good investment if the rate of change in inflation is negative.

The conclusion in my earlier article noted, "in these tough times in the market, stock price returns will be impacted by events happening in the future and not by those that have already occurred. From an emotional standpoint, it is easy to let ones feelings for future stock expectations get clouded by past events. Being able to overcome these past influences is important in achieving positive investment returns."

Source:

Inflation vs. deflation: Prepare for Either

Fidelity Viewpoints

By: Bill Ralls, CFA

June 2, 2010

https://news.fidelity.com/news/article.jhtml?guid=/FidelityNewsPage/pages/fidelity-prepare-for-inflation-or-deflation&topic=investing

No comments :

Post a Comment