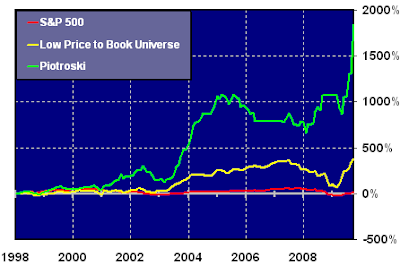

One of the American Association of Individual Investors' better performing stock screens over the long run is the Piotroski Price to Book Screen.

Of late the number of companies passing the screen's criteria has been slim to none. The criteria of the screen are:

Of late the number of companies passing the screen's criteria has been slim to none. The criteria of the screen are:

- The price-to-book ratio ranks in the lowest 20% of the entire Stock Investor AAII database.

- The stock does not trade on the over-the-counter exchange.

- The return on assets for the last fiscal year (Y1) is positive.

- Cash from operations for the last fiscal year (Y1) is positive.

- The return on assets ratio for the last fiscal year (Y1) is greater than the return on assets ratio for the fiscal year two years ago (Y2).

- Cash from operations for the last fiscal year (Y1) is greater than income after taxes for the last fiscal year (Y1).

- The long-term debt to assets ratio for the last fiscal year (Y1) is less than the long-term debt to assets ratio for the fiscal year two years ago (Y2).

- The current ratio for the last fiscal year (Y1) is greater than the current ratio for the fiscal year two years ago (Y2).

- The average shares outstanding for the last fiscal year (Y1) is less than or equal to the average number of shares outstanding for the fiscal year two years ago (Y2).

- The gross margin for the last fiscal year (Y1) is greater than the gross margin for the fiscal year two years ago (Y2)

- The asset turnover for the last fiscal year (Y1) is greater than the asset turnover for the fiscal year two years ago (Y2).

Currently, only one company out of AAII's database of companies passes the screening criteria. The company is a Hong Kong based company, Highway Holdings Ltd. (HIHO) and trades on the NasdaqCM exchange.

Investors are highly encouraged to fully research any company mentioned before purchasing. In the case of HIHO, it is a small company trading at a stock price below $5 per share. The stock's market capitalization is $6.1 million. These below $5 stocks are typically very volatile investments.

Investors are highly encouraged to fully research any company mentioned before purchasing. In the case of HIHO, it is a small company trading at a stock price below $5 per share. The stock's market capitalization is $6.1 million. These below $5 stocks are typically very volatile investments.

No comments :

Post a Comment