In early November Nouriel Roubini wrote in the Financial Times that the

Mother of all carry trades faces an inevitable bust. Roubini states the rise in risky asset values: equities, high yield bonds, etc. has been driven by the carry trade with the U.S. Dollar.

"Roubini states, so what is behind this massive rally? Certainly it has been helped by a wave of liquidity from near-zero interest rates and quantitative easing. But a more important factor fueling this asset bubble is the weakness of the US dollar, driven by the mother of all carry trades. The US dollar has become the major funding currency of carry trades as the Fed has kept interest rates on hold and is expected to do so for a long time. Investors who are shorting the US dollar to buy on a highly leveraged basis higher-yielding assets and other global assets are not just borrowing at zero interest rates in dollar terms; they are borrowing at very negative interest rates – as low as negative 10 or 20 per cent annualised – as the fall in the US dollar leads to massive capital gains on short dollar positions."

"The U.S. dollar has become a huge ‘carry trade’ vehicle for all risky assets. Historically, there is no correlation at all between the DXY index (the U.S. dollar index) and the S&P 500. In the past eight months, that correlation is 90%. Ditto for credit spreads — zero correlation from 1995 to 2008, but now it has surged to 90% since April. There was historically a 70% inverse correlation between the U.S. dollar and emerging markets, such as the Brazilian Bovespa, and that correlation has also increased to 90% since the spring. Even the VIX index, which historically has had no better than a 20% correlation with the U.S. dollar, has now sent that correlation surge to 90%. Amazing. The inverse correlations between the U.S. dollar and gold and the U.S. dollar and commodities were always strong, but these too have strengthened and now stand at over 90%."

The reason for the heightened focus on the carry trade is because when it is unwound, negative shocks can inflict risky assets and weak currency economies. Earlier this year, this type of shock

inflicted Latvia and other Eastern and Central European economies. Does the data really support this carry trade risk though?

According to Larry Hathewey, an economist at UBS, in a report dated November 12, 2009, data on leverage and financial flows do not support the assertion that gains in global equity, credit, or most commodity prices have been primarily driven by leverage and liquidity. Hatheway indicates that margin debt and stock market volumes should be higher for the carry trade to be leading to bubles in these riskier asset investments. In fact the opposite is true.

According to an article in the Globe and Mail,

Dr. Doom, borrowing and bubbles,

"If a ‘speculative bubble' were driving equity prices higher, presumably volumes would reflect the exuberance,” Mr. Hatheway said. “Yet average daily trading volume on the New York Stock Exchange has been declining since 2005, reversing the strong trend growth over the previous decade."

There is one bubble that is worth noting, UBS suggested. As the price of gold has increased, so too has derivative volumes."

"There, soaring prices have coincided with an increase in derivatives volumes. That squares with our view that what is driving gold prices is not a supply-demand imbalance in the physical market, but rather an increase in financial demand, he said.

"Gold prices and derivatives activity, in other words, show signs of a market driven by financial demand, either for hedging or speculative purposes. But what's notable is that gold is unique – equity, credit and even government bond markets do not show evidence of a similar pick up in derivatives activity."

The U.S. is not the only country whose currency continues to weaken. In Japan, the BOJ has its target interest rate near zero as well. In Q3, Japan's nominal GDP fell at a .3% rate due to continued price weakness and seems unable to shake off deflation. This lower rate in Japan will put downward pressure on the Yen, thus providing another currency for the carry trade.

In the end though, I believe Larry Hatheway points to important data that indicates the carry trade may not be fueling this global market melt up. As Hatheway noted in his research report,

"we (UBS) believe price gains largely reflect improved fundamentals, including signs of global economic recovery, the strength of emerging economies, and a recovery of earnings. Financial market activity—including the size of the financial sector as well as funds flows and derivatives activity—remains subdued by historical standards."

"Until leverage resumes market outcomes will be driven mostly by growth and earnings expectations. Importantly, as well, uncertainty about monetary policy 'exit strategies' is likely to boost market volatility next year. And with many asset classes now close to 'fair value', risk-adjusted returns are likely to be lower in the year to come."

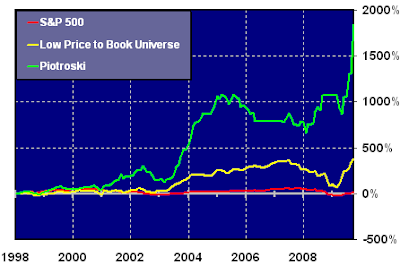

As the above chart shows, P&G has generated a flat return on a price only basis versus a return in excess of 20% for the S&P 500 Index. As investors then, for 2010, look for opportunities in higher quality stocks that have not participated in this mostly lower quality stock rally of 2009.

As the above chart shows, P&G has generated a flat return on a price only basis versus a return in excess of 20% for the S&P 500 Index. As investors then, for 2010, look for opportunities in higher quality stocks that have not participated in this mostly lower quality stock rally of 2009.