(I originally posted the following article on The DIV-Net on July 13, 2008)

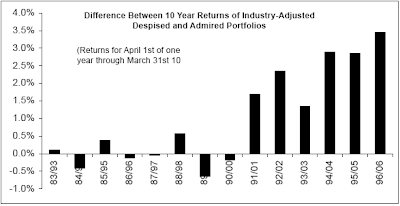

The CXO Advisory Group website highlighted findings from a research report titled Stocks of Admired Companies and Despised Ones by Deniz Anginer, Kenneth Fisher and Meir Statman. In short, the study's authors tested whether the top companies in Fortune magazine's list of America's Most Admired Companies underperformed the companies that ranked in the bottom of the list. The following table taken from the study summarizes some of the findings.

portfolios during the ten years: April 1983 – March 2006.

...the stocks of companies least admired by the ostensibly well-informed may well outperform the stocks of the companies most admired.

As Old School Value's post last Saturday noted, All Intelligent Investing IS Value Investing,

Value investing...revolves around paying less or a fair amount to [a company's] real value, referred to as intrinsic value...

"High achievers (in life and in the market) frequently step outside their comfort zone. That’s the way they learn and make progress. At the same time, they also expect to fail (more often than not), but do not see failure or mistakes they make as problems, but as educational experiences.

The natural instinct of all of us is to seek safety and shelter, unfortunately at the exact same time when we should be aggressive and risk tolerant. Those who do well in the market understand this natural human tendency and they consistently work against it when others are doing the exact opposite.

The key for today is to first understand what your comfort zone is and then take a step outside of it. Remember, the market doesn’t reward comfort and decisions that “feel” good to make. That’s the law of nature and it is true of this market like any other."

Buy Stocks of Companies Experts Hate?

CXO Advisory Group, LLC

February 14, 2007

http://www.cxoadvisory.com/blog/external/blog2-14-07/

Stocks of Admired Companies and Despised Ones

By: Deniz Anginer, Kenneth Fisher and Meir Statman

February 2007

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=962168#PaperDownload

Your Comfort Zone

The Kirk Report

By: Charles Kirk

July 8, 2008

http://www.thekirkreport.com/2008/07/your-comfort-zo.html

No comments :

Post a Comment