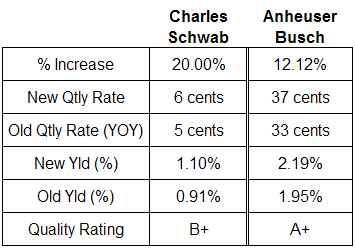

Both Charles Schwab (SCHW) and Anheuser Busch (BUD) announced dividend increases this week.

Charles Schwab

Schwab's new quarterly dividend of 6 cents per share is a 20% increase over the 5 cents per share dividend paid in the same quarter last year. The 5-year dividend growth rate for the company is approximately 24%. This rate of growth does not include the $1.00 special dividend paid by the company in the third quarter of 2007. The projected payout ratio is approximately 22% based on 2008 estimated earnings per share of $1.09. The 5-year average payout ratio is 16%. Schwab has a S&P Quality Ranking of B+.

Anheuser Busch

The Anheuser Busch quarterly dividend increases to 37 cents per share versus 33 cents per share in the same quarter last year. This represents a 12% year over year increase and is greater than the company's 5-year average dividend growth rate of 8%. The projected payout ratio is approximately 47% based on 2008 estimated earnings per share of $3.13. The 5-year average payout ratio is 40%. BUD has a S&P Quality Ranking of A+. Investors should note Anheuser Busch has an agreement with InBev NV (INTB.BR) whereby InBev acquires BUD for $70 per share in cash. The deal is expected to close by year end.

Charles Schwab

Schwab's new quarterly dividend of 6 cents per share is a 20% increase over the 5 cents per share dividend paid in the same quarter last year. The 5-year dividend growth rate for the company is approximately 24%. This rate of growth does not include the $1.00 special dividend paid by the company in the third quarter of 2007. The projected payout ratio is approximately 22% based on 2008 estimated earnings per share of $1.09. The 5-year average payout ratio is 16%. Schwab has a S&P Quality Ranking of B+.

Anheuser Busch

The Anheuser Busch quarterly dividend increases to 37 cents per share versus 33 cents per share in the same quarter last year. This represents a 12% year over year increase and is greater than the company's 5-year average dividend growth rate of 8%. The projected payout ratio is approximately 47% based on 2008 estimated earnings per share of $3.13. The 5-year average payout ratio is 40%. BUD has a S&P Quality Ranking of A+. Investors should note Anheuser Busch has an agreement with InBev NV (INTB.BR) whereby InBev acquires BUD for $70 per share in cash. The deal is expected to close by year end.

(click on table/chart for larger image)

1 comment :

David,

Thanks for the update. The BUD news is pretty good in terms of dividend income increase. The problem is that I sold half of my position.. And I will sell the other part by year end wehn the deal closes.

I don't know if I should be happy or sad - the short term investor in me is happy that I managed to buy a stock that was being acquired while the long-term investor in me suffers from the loss of dividend income growth potential..

Post a Comment