As I outline the factors one considers when deciding what percent of their investments are allocated to stocks, bonds and cash, I am making the assumption readers know what these broad investment classes consist of. For those that want to read more on the investment classes, click

this link.

As one determines how their investments should be allocated, several factors need to be taken into consideration:

- The investment objective for the funds. Establishing the investment objective for the investments enables one to pinpoint a time horizon. Are the funds needed near term for an upcoming purchase or are the funds being accumulated for retirement.

- The time horizon for the investments. Will the funds need to be withdrawn in five years, ten years, fifteen years or a longer period of time? Generally, the longer ones time horizon, the more likely one can invest in assets, such as equities, that fluctuate (volatility) in value by a larger amount.

- Ones risk tolerance. This determines the level of volatility one is comfortable being exposed to. Investments with potentially higher returns tend to exhibit wider fluctuations in value in the short run.

- Ones personal preferences and constraints and any tax, legal, or regulatory issues.

- And lastly, rate of return target.

Once the above factors have been addressed, an investor can determine the appropriate type of investments for their portfolio. At this point, I will focus on the question of stocks or bonds.

First, let's look at the income component of stocks and bonds. Let's say an investor purchases a 10-year treasury bond and holds it until maturity. Today, the investor would earn 4.78% on a before tax basis. In the case of treasuries, these investments are exempt from state taxation. Going forward in this analysis, I will exclude the impact of state tax rates on the various investments.

Continuing with the treasury example, the investor would earn 4.78% per year over the next 10-years. If the investor is in the 35% tax bracket, the amount the investor retains--after tax--of the 4.78% is (4.78% * (1-tax rate)) or 2.91%. The other important component that needs to be considered is the rate of inflation. Inflation will erode ones purchasing power. The current core rate of inflation (this excludes food and energy components) is 2.6%. As a result, after tax and after inflation, the 4.78% becomes .31%. Not much of a return.

The dividend yield on stocks, that is, the S&P 500 Index is currently 1.8%. At this point, qualifying dividends are taxed at 15%; therefore, the after tax yield on the dividend income is 1.53%. After 2.6% of current inflation, the return would be negative.

Is this an accurate comparison? When investing in stocks, dividends simply represent a portion of the company's earnings that are paid out to shareholders.

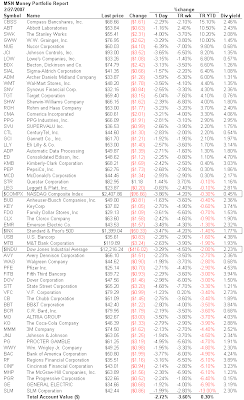

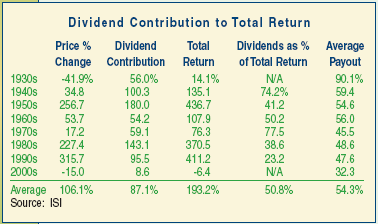

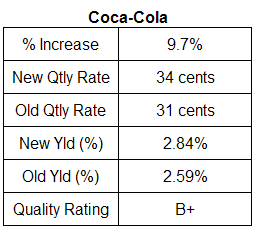

(click on table for larger image)

So reevaluating the stock analysis, let's look at the earnings yield of the S&P 500 Index. The earnings yield is the inverse of the price to earnings ratio. The forward PE for the S&P 500 Index is approximately 16. The inverse, or earnings dividend by price, equals 6.25%. On a worst case basis, let's assume there isn't a dividend tax advantage and reduce the earnings yield by the 35% tax rate. The after tax earnings yield would equal 4.06%. We would not reduce this by the Consumer Price Index. Why?

As noted in an article by Donald Luskin, titled

Stocks vs. Bonds: Stocks Win: But where stocks really shine is as protection against inflation. It's far from exact, but generally speaking corporate earnings should grow with inflation. If a company sells apples, and the price of apples goes up by 30% over 10 years because of inflation, you can be pretty sure that the company's earnings will go up 30% too, all else equal.

With stocks then, on an after tax after inflation basis, the stock yield is 4.06% while the bond yield is .31%.When answering the question of stocks versus bonds, one must also consider the potential volatility or market value fluctuation of the investment. Knowing the investment time horizon is a critical element in answering stocks or bonds.In an article by Shawn Allen of InvestorsFriend Inc., titled Are Stocks Really Riskier Than Bonds?, he notes:

When it comes to long-term investors, virtually the entire investment community is focused on the wrong definition of risk. Much of what is written about risk is at best inappropriate and at worse completely wrong for a long-term investor. This is caused by an over emphasis on short-term volatility.

For long-term investors we need to have a proper definition of risk. Financial academics and the investment community generally define risk as the short-term (annual, monthly or daily) volatility of returns from an investment. The volatility of returns is measured by variance or standard deviation.

From the perspective of a long-term investor, this definition of risk is flawed for two reasons:

1. The analysis and conclusions almost always focuses on the volatility of annual (or even monthly or daily) returns. An annual focus might be appropriate for many investors, but long-term investors should be mostly concerned about risks associated with their long-term wealth level and not primarily focused on the bumps along the way.

2. The analysis and conclusions are almost always based on nominal returns and ignore the erosion of purchasing power caused by inflation. For short term investors, inflation may not a be a big concern but it has a huge impact in the long-term.

As to the second point above, it seems self evident that better conclusions will be reached using real (inflation adjusted) returns rather than nominal returns.

As to the first point above, under the annual volatility definition of risk, stocks are considered much more risky than long-term Bonds or Treasury Bills. Yet, it is a fact that stocks have significantly outperformed both Bonds and T-Bills over 30 year periods. In each and every 30 year "rolling window" from 1926 - 1955 through to 1975 - 2004, stocks have provided a higher (after inflation) return. But due to higher annual volatilities, stocks are considered more risky! To avoid risk (annual volatility) you are advised to put some money into Bonds or T-Bills which in fact are almost guaranteed to under perform stocks in the long run. This kind of thinking on risk is hazardous indeed to your long-term wealth. (That is, if your goal is wealth maximization at some distant point like 20 or 30 years in the future, as it is for many investors).

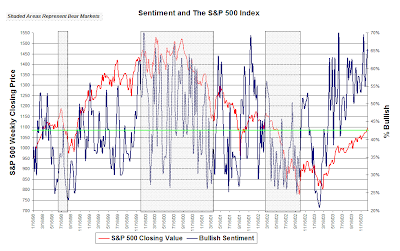

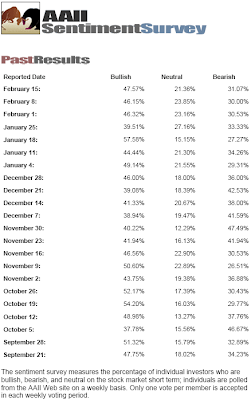

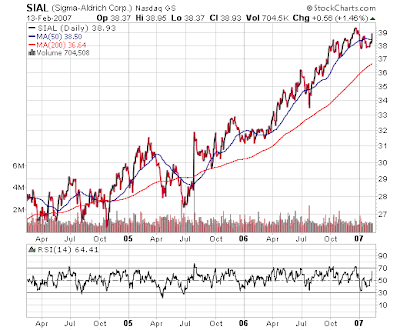

(click on charts for larger image)

Certainly over long time horizons, stock volatility is lower than volatility in the short term. Additionally, stocks provide a better opportunity to generate after tax returns that out pace inflation. One advantage of bonds is they can dampen the short term volatility of an investment portfolio. In the end, the investor must be comfortable with the investment portfolio they establish.

Source:

Stocks vs. Bonds: Stocks Win

By: Donald Luskin

Ahead of the Curve

SmartMoney.com

June 17, 2005

http://www.smartmoney.com/aheadofthecurve/index.cfm?story=20050617

Are Stocks Really Riskier Than Bonds?

By: Shawn Allen, CFA, CMA, MBA, P.Eng.

InvestorsFriend, Inc.

Januray 28, 2007

http://www.investorsfriend.com/stocksriskierthanbonds.htm

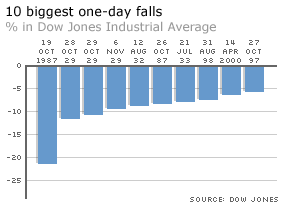

Source: BBC News Online

Source: BBC News Online