In an end of year strategy piece written by Legg Mason strategist, David Nelson, CFA, he notes large capitalization equities have been outperforming since May 2006. In fact, the Dividend Aristocrats tracked on this blog continue to achieve strong market returns so far in 2007.

(click on table for larger image)

Source: Legg Mason December Market Commentary

Legg Mason's commentary notes:

Source: Eaton Vance, February 2007

Source: Eaton Vance, February 2007

Sources:

The Dividend Story

Eaton Vance

February, 2007

http://www.eatonvance.com/mutual_funds/dividend_story.php

Market Commentary

By: David Nelson, CFA

Legg Mason

December, 2006

http://www.leggmason.com/funds/knowledge/management/December2006MarketCommentary.pdf

We regard the shift in leadership from small and mid cap stocks to large and mega caps as the most significant development in the equity market in 2006. We believe the performance differential between these market cap sectors since May is solid evidence that the shift has occurred. How long it will last we do not know, but if our assessment is correct, we expect it to be a period measured in years, rather than months (emphasis added).

The reemergence of mega cap stocks as market leaders has been a mixed blessing for many investment managers. One might even say that “never have so many had so little fun in a generally rising market.”The reason is that a market dominated by mega-cap stocks is a tough market for most equity managers to beat. The late 1990s—while a bonanza for equity investors as a whole—were a nightmare for portfolio managers in terms of relative performance, as few were able to keep up with the S&P 500 Index, which was being driven by the relentless advance of 25 or 30 mega caps such as Dell, Microsoft, Intel, Cisco and the like. The year just ended witnessed a similar struggle as just 19% of all actively managed U.S. diversified equity funds were ahead of the S&P 500 through December 27, 2006. This is the worst yearly aggregate relative performance showing since 1998.

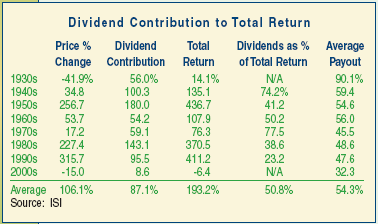

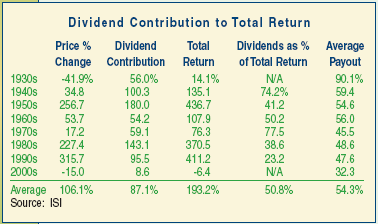

Within the large/mega capitalization portion of the equity market, high quality dividend paying equities have experienced an extended stretch of weaker total return over the last several years. As noted in the table below, the contribution of dividends to the return in the S&P 500 Index has been declining since the 1980's.

(click on table for larger image)

Source: Eaton Vance, February 2007

Source: Eaton Vance, February 2007From a positive perspective, over the last four years, earnings growth for the S&P 500 companies has been increasing at a mid teens percentage growth rate. The dividend growth rate for the S&P 500 Index has been double digits, 10.8% last year, but growing at a lower rate than earnings. Standard and Poor's recently increased the anticipated dividend payment amount for for the S&P in 2007. The resulting percentage growth rate would be 11% higher in 2007 versus the 2006 dividend payment amount. Additionally, the number of companies paying a dividend has been in an uptrend since 2001.

One interesting dividend aspect is the payout ratio for the S&P 500 has declined to historically low levels. Currently, the payout ratio is near 30%.

(click on chart for larger image)

One interesting dividend aspect is the payout ratio for the S&P 500 has declined to historically low levels. Currently, the payout ratio is near 30%.

(click on chart for larger image)

One reason this has occurred is the previously noted fact that earnings are growing at a faster rate than dividends. In lieu of companies growing dividends at an even faster rate, they have resorted to initiating large stock buybacks. These large buybacks and special dividends are evidence of the strong cash flow growth for larger companies. An S&P report dated January 4, 2007 notes special dividends have surged in lieu of a higher dividend growth rate. Specials are one time payments, thus not committing the company to higher dividend payments on an ongoing basis:

Standard & Poor’s data shows that dividend extras, such as one-time dividend payments and special dividends, increased 14.3% to 622 during 2006, up from the 544 recorded in 2005. “The December surge in dividend extras was the largest since 1978. While dividends have increased slowly, extras have grown quicker since they are generally regarded as a single payment, with the company not obligated to make any additional payments,” concludes Silverblatt.

As noted earlier, earnings for the S&P 500 companies have been growing at double digit rates over the past four years; however, it appears 4th quarter 2006 earnings will come in at a growth rate of 9.9%. In an environment where earnings growth is slowing, higher quality large cap companies tend to lead market returns. The strong performance of larger cap equities since May of last year may be a sign of better returns for larger company stocks going forward.

Sources:

The Dividend Story

Eaton Vance

February, 2007

http://www.eatonvance.com/mutual_funds/dividend_story.php

Market Commentary

By: David Nelson, CFA

Legg Mason

December, 2006

http://www.leggmason.com/funds/knowledge/management/December2006MarketCommentary.pdf

No comments :

Post a Comment