Yesterday the S&P 500 Index was down approximately 3.5%. The market had gone over 900 days (almost four years) without a decline of more than 2%. As large market declines do actually occur from time to time, how would the media "headline" this market event versus prior market pullbacks.

Some of the notable headlines (highlights added):

Some of the notable headlines (highlights added):

- At CNNMoney: Stocks rebound after Market Meltdown. The lead paragraph begins, "Stocks recovered from the previous session's brutal selloff,..."

- At The Wall Street Journal: Lead quotes on page one of the Journal's website.

- "The global markets plunge in stocks..."

- U.S. stocks revived from a major selloff..."

- At the Cincinnati Enquirer: Dow's worst day in years. China sell-off sparks 416-point plunge.

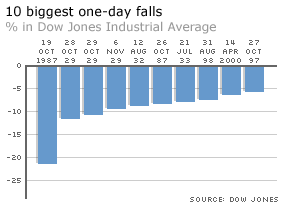

How does Tuesday's decline compare with past market selloffs? Following is a chart of a few of the largest percentage declines for the Dow Jones Industrial Average.

Source: BBC News Online

Source: BBC News OnlineThe largest one day percentage decline occurred on Black Monday, October 19, 1987 when the Dow declined 508 points or 22.6%. Today, a similar 22.6% decline in the Dow would equal a decline of 2,772 Dow points.

Some of the headlines after Black Monday:

Some of the headlines after Black Monday:

- Stocks Plunge 508 Amid Panicky Selling, Wall Street Journal, 10/20/87

- Money Managers Trying to Form New Strategies After Market Rout, Wall Street Journal, 10/20/87

- How the Bull Crashed Into Reality, BusinessWeek, 11/2/87

It is important to keep the magnitude of market corrections in perspective. Certainly, today a one day market decline of 22.6%, 2,772 points, would appropriately be called a plunge or brutal selloff. But Tuesday's 3% decline hardly qualifies as a "plunge". Additionally, at The Big Picture web site, it is noted "the Dow Industrials have not had a 2% one-day rally in more than 500 trading days, either.”

This market has been one that has moved higher with very little resistance. A pullback or consolidation would be a healthy one. A number of key factors will determine the future direction of the market, the economy being an important one.

The magnitude of the point declines in the Dow may seem large, but it is the percentage movements that really count.

This market has been one that has moved higher with very little resistance. A pullback or consolidation would be a healthy one. A number of key factors will determine the future direction of the market, the economy being an important one.

The magnitude of the point declines in the Dow may seem large, but it is the percentage movements that really count.

No comments :

Post a Comment