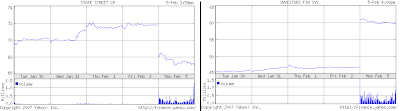

Today State Street Corp. (STT) announced a $4.18 Billion acquisition of Investor Financial Services Corp. (IFIN). State Street's stock closed down $4.67 or 6.5% and IFIN rose $12.85 or 27.37% on the news.

As I noted in my post dated 12.22.2006 titled State Street Raises Dividend...But STT's dividend has been slowing. In the post I suggested maybe the slower dividend growth was an indication by the board of directors that STT's business was slowing. I have noted in other posts that slower dividend growth could be an indication the board/company might have other uses for the cash, such as acquisitions or stock buybacks. In any event, was STT's slower dividend growth rate a signal of a pending acquisition? Those companies that begin to exhibit slower dividend growth warrant further research by investors. An investor must be comfortable with the business strategy of these investments.

(click on chart for larger image)

No comments :

Post a Comment