There are three features of the tax code that favor holding certain assets over others in taxable accounts.

- First, long-term capital gains are taxed at lower rates when realized in taxable accounts;

- Second, losses can be realized and the government can share the loss in taxable accounts;

A recent article by the American Association of Individual Investors describes which type of assets should be considered for taxable and non taxable accounts.

- Third, capital gains taxes can be avoided by awaiting the step-up in basis at death or giving the appreciated asset to charity instead of a cash contribution in taxable accounts.

401(k) Plans and Other Tax-Deferred Retirement Accounts

The first asset to place in retirement accounts is bonds, which tend to generate returns that are almost entirely taxed as income. The exception is that any liquidity reserves—usually short-term fixed income held for emergencies and other short-term cash needs—should be held in taxable accounts where it is readily available. The next choice for assets in retirement accounts are REITs (real estate investment trusts), which pay large cash dividends that, unlike dividends on other assets, are taxed at ordinary income tax rates.

Tax-inefficient stock funds come next in the retirement account pocket, and these include most actively managed stock funds. The most tax-inefficient funds are those that realize capital gains quickly, especially those that realize substantial short-term capital gains.

Taxable Accounts

The first assets to place in taxable accounts are assets you never intend to sell or that you will give to charity as an appreciated asset, and passively held stocks and other assets that are expected to provide substantial long-term capital gain potential. The key is that you want to let capital gains grow unrealized for long horizons. The stocks can be tax-efficient stock mutual funds that realize (and thus distribute) minimal capital gains, such as index funds, or individual stocks that you will passively hold for at least a decade. Other good candidates include tax-managed stock mutual funds and index funds or exchange-traded funds that track a large-cap or total market stock index. Raw real estate that will be bought and held for long horizons would also be a good asset to hold in taxable accounts, as would gold bullion (remember, though, these are not investment recommendations, they are simply suggestions on where to locate them if you want to own them). Although not optimal, it is better to hold actively managed stock funds—especially those that realize minimal short-term capital gains—rather than bonds or bond funds, in taxable accounts. The last asset in the taxable pocket should be whatever asset is needed to satisfy your asset allocation that cannot be held in a retirement account.

One key to reviewing asset location decisions is to not let the tax tail wag the dog. Of utmost importance is one needs to be saving. If this means all investment assets are in a tax deferred account then that is fine. Lastly, other tax deferred accounts, such as Roth IRAs and their special tax rules must be considered as well.

Source:

Picking the Right Tax Pocket for Your Assets

AAII Journal

2007

http://www.aaii.com/includes/DisplayArticle.cfm?Article_Id=2973&digit=473

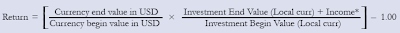

An investor needs to keep in mind that foreign currency exchange rates can boost ones returns and possibly make an underperforming investment look more attractive. Also, prognosticators that forecast foreign exchange rates are often incorrect. The point is, a continued weak dollar is not necessarily a given.

An investor needs to keep in mind that foreign currency exchange rates can boost ones returns and possibly make an underperforming investment look more attractive. Also, prognosticators that forecast foreign exchange rates are often incorrect. The point is, a continued weak dollar is not necessarily a given.

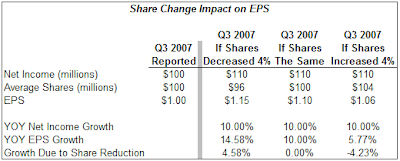

"buybacks boost EPS above the level that underlying organic growth in net income would on its own." The BCG report notes, "that EPS growth is not necessarily a differentiator of multiples. And when it is, investors are extremely sensitive to

"buybacks boost EPS above the level that underlying organic growth in net income would on its own." The BCG report notes, "that EPS growth is not necessarily a differentiator of multiples. And when it is, investors are extremely sensitive to