U.S. investors have experienced strong returns from their international investments over the past five years. A large part of the strong international results can be attributed to the weak dollar versus many foreign currencies. The U.S. investor's returns are enhanced because the foreign currency buys more dollars when converted.

An article in the November 2007 American Association of Individual Investors AAII Journal, Currency Exchange Rates: The International Wild Card ($), notes some economic impacts on exchange rates:

From an economic viewpoint, common sense dictates that if the demand for a currency exceeds its supply in the short term, the currency will appreciate. So when the goods and services of a country are in demand by foreign purchasers—a net trade balance surplus—the currency has a tendency to appreciate. Conversely, when foreign goods and services are in demand domestically—a net trade deficit—the currency tends to depreciate.

Inflation, productivity and costs in a country all contribute to trade balances and currency pressures. In addition, fiscal policy that stimulates or depresses economic growth, monetary policy, the money supply and central bank action—all move markets and currency exchange rates.

There is no precise or direct summary indicator of all these forces. But differences in interest rates between the domestic market and a foreign market or markets can reveal a great deal.

The differences in real rates of return, nominal return less inflation, probably provide an even better window to currency risk. In order to protect exchange rates, some countries at times maintain relatively high real rates of interest to generate demand for their currency. High real rates of interest, however, take their toll on domestic economic growth, many times forcing countries to devalue their currency or reduce interest rates, adversely affecting foreign investors who hold investments denominated in the currency.

The following table that appears in the article shows the return enhancement for a U.S. investor versus some foreign currencies over the past five years.

(click on table for larger image)

An investor needs to keep in mind that foreign currency exchange rates can boost ones returns and possibly make an underperforming investment look more attractive. Also, prognosticators that forecast foreign exchange rates are often incorrect. The point is, a continued weak dollar is not necessarily a given.

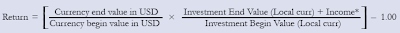

An investor needs to keep in mind that foreign currency exchange rates can boost ones returns and possibly make an underperforming investment look more attractive. Also, prognosticators that forecast foreign exchange rates are often incorrect. The point is, a continued weak dollar is not necessarily a given.Lastly, the AAII Journal article provides several tables detailing the impact on returns for various percentage changes in the dollar exchange rate. The formula for calculating currency adjusted returns is:

(click on formula for larger image)

Source:

Currency Exchange Rates: The International Wild Card ($)

AAII Journal

November 2007

http://www.aaii.com/login/index.cfm?CALLER=/includes/DisplayArticle.cfm&denied=jrnl&Article_Id=3277&CFID=5700089&CFTOKEN=64684055

AAII Journal

November 2007

http://www.aaii.com/login/index.cfm?CALLER=/includes/DisplayArticle.cfm&denied=jrnl&Article_Id=3277&CFID=5700089&CFTOKEN=64684055

No comments :

Post a Comment