Real Estate Investment Trusts or REITs can serve as a diversifying vehicle for investment portfolios. REITs generally invest in various types of real estate properties, for example, apartment buildings, healthcare facilities and industrial properties. REITs are required to payout, in the form of dividends, at least 90% of the companies taxable income in order for the REIT to receive special tax treatment from the IRS.

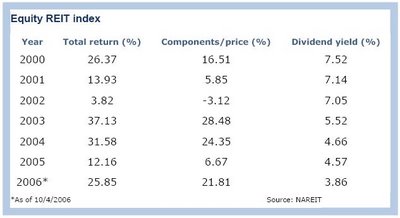

A word of caution at this time is many REIT shares have experienced significant price appreciation over the last few years. A common index that tracks the performance of REITs, the NAREIT Index, has seen its yield decline from over 7% in 2000 to just over 3% currently. This lower yield is due, in large part, to the appreciation of REIT share prices.

(source: www.bankrate.com)

(source: www.bankrate.com)Source:

REITs can boost yield returns, but buy cautiously

By: Laura Bruce

www.bankrate.com

November 10, 2006

No comments :

Post a Comment