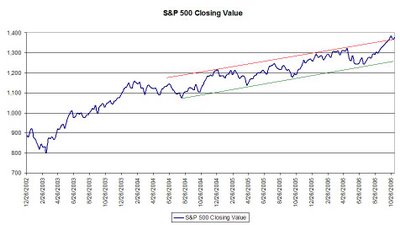

In the long run, a market or a stock's, underlying fundamentals will determine whether an investor makes or loses money on a particular investment. In the short run though, technical factors are important issues to consider when investing. Recently, an interesting set of charts was displayed on The Big Picture web blog. The market chart displayed on the site (click here) focused on the Dow. Below I have displayed similar information for the S&P 500 Index. The Dow recently reached a new all time high, while the S&P 500 Index is still below its 2000 high of 1,527. The S&P continues to trade in a longer term up trend channel; however, the index is trading at the top of the channel's range (red line).

(click graphs for larger image)

From a sentiment standpoint, the better time to invest in the market is when the bullish sentiment percentage is lower. The sentiment figures are provided by The American Association of Individual Investors.

From a sentiment standpoint, the better time to invest in the market is when the bullish sentiment percentage is lower. The sentiment figures are provided by The American Association of Individual Investors.I do not advocate market timing; however, reviewing market technicals will provide insight to overall market trends. Some might say investing in the stock market is like investing in real estate. One makes money in real estate not based on what they sell a property for, but based on the price paid for the property. In other words, buy low and sell high.

2 comments :

buy low and sell high works -- what we often see is: "buy high and sell higher."

The big problem with "buy higher: is the increased risk factor, and little room for error.

In the event of any issues, (corrections, recession, externalities) the buy high will become sell lower.

I certainly agree. I look at stocks like Nordstrom (JWN). On Thursday Goldman Sachs upgrades the stock from sell to neutral. This is after JWN has gone from $32 to $46 in just a few months. Not to sayJ WN is still not attractive at this price, but your point is well taken-there is smaller room for error.

Post a Comment