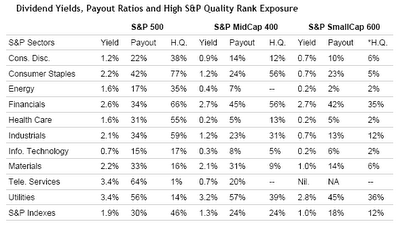

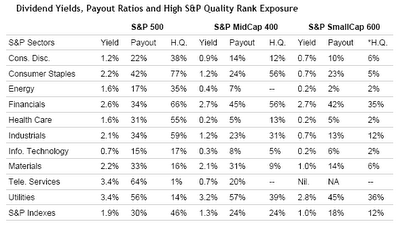

A recent BusinessWeek online article titled, Making Dividend Plays Pay, and an excerpt from a Standard Poor's Equity Research report, contained an analysis of the yields, payout ratios, and quality make up by sector for several S&P indices.

The article outlines the importance of reinvested dividends:

(click on chart for larger image)

The article outlines the importance of reinvested dividends:

"Dividends—those steady streams of periodic payments received by equity investors—may seem as unexciting as a Social Security check, but you might think again when you realize that reinvested dividends have actually contributed more than 40% of the S&P 500's total return since 1929 (emphasis added). What's more, the S&P 500 dividend yield averaged nearly 4% in all years since the mid-1930s and averaged nearly 6% during the 1940s. Things look a little different these days, of course. The yield on the "500" has averaged only 1.6% thus far this decade, after averaging only 2.4% during the 1990s..."

S&P believes the economy is entering a slower growth phase. As a result, they believe investors should focus on higher quality dividend paying stocks:

"Due to the expected tepid market performance, S&P recommends that investors gravitate toward sectors and companies that offer relatively high dividend yields and have consistently increased their earnings and dividends over an extended period of time."

Source:

Making Dividend Plays Pay

SAM STOVALL

SAM STOVALL'S SECTOR WATCH

BusinessWeek Online, September 5, 2006 http://www.businessweek.com/investor/content/sep2006/pi20060905_559905.htm

No comments :

Post a Comment