When analyzing dividend growth stocks, reviewing a company's cash flow is an important aspect in the analysis. Companies that generate strong growth in cash flow have the ability to: increase the dividend, buyback stock or pay down debt with the cash, just to name a few uses. An investor should be wary of stocks that trade at too high of a yield though. Stocks paying too high a yield can be a precursor to underlying fundamental problems with a company.

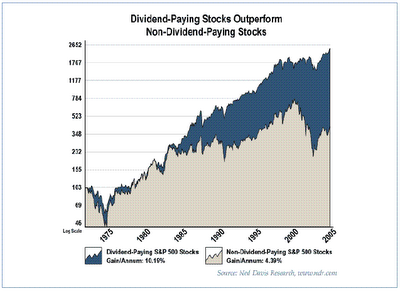

Historically, companies that pay a dividend have outperformed non-dividend payers:

(click on graphs for larger image)

Reinvesting of the dividends is another important component to the growth of dividend paying stocks. In lieu of reinvesting the dividend back into the same stock, an investor can choose to receive the cash dividend and reinvest the proceeds into other attractively valued dividend growth companies within ones portfolio:

The Power of Reinvesting Dividends

- $10,000 invested in Ibbotson's large cap companies in 1980

Source:

6 Secrets to Finding Dividend "Money Machines"

Motley Fool Income Investor, October 16, 2006 http://aol.fool.com/shop/newsletters/08/index.htm?authed=n

No comments :

Post a Comment