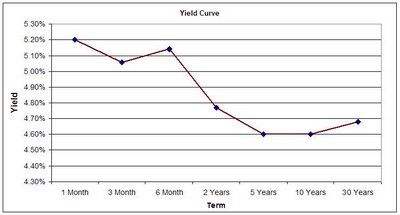

Many economist have focused on the yield curve and its shape to provide clues about future economic growth. One reason economists focus on the yield curve is an inverted yield curve has preceded prior recessions; however, every inverted yield curve has not resulted in a recession. The current shape of the yield curve is an inverted one:

(click on graph for larger image)

A recent Federal Reserve publication noted:

"...Despite the evidence linking the yield curve to economic growth, and even though yield-curve inversions preceded the two most recent recessions, many have suggested that the yield curve no longer reliably predicts economic growth. Noting that the economy is continually evolving, particularly the financial sector, they discount past successes. They point to two recent “near misses” in 1995 and 1998, when a flat yield curve did not presage slow growth. And indeed, evidence since the early 1990s suggests that the relationship between the yield curve and growth has shifted, if not disappeared."The study concluded:

"Economists do not currently have a well-accepted theory of why the yield curve predicts future economic growth. Given that, speculating on whether or not the yield curve is truly predicting a recession remains exactly that: speculation. Using the yield curve remains an exercise in judgment that requires balancing the long, successful history of the yield curve’s predictive power with some recent evidence of its fading foresight. It also requires judgment because predictions of real activity represent only one facet of the problem facing the FOMC: Inflation is the other. Still, as the Committee becomes more familiar with the risk-management approach to policymaking, it seems that the signal from the yield curve deserves some weight."The other variable garnering a large part of the Fed's attention at this time is the level of inflation. As noted by the chart below, data indicate inflation is subsiding.

(click on graph for larger image)

The one caveat from the Federal Reserve article is the author's belief that events may be different this time. Keep in mind, history has a tendency to repeat itself.

At this stage in the economic cycle, an investor should consider focusing their large cap investments on the larger higher quality dividend paying companies. These firms should weather an economic slow down better than smaller, higher valuation companies.

No comments :

Post a Comment