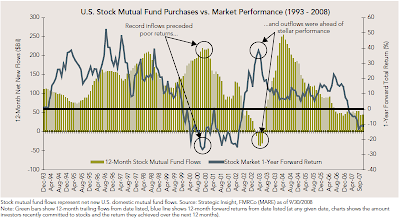

Not too surprisingly, mutual fund investors tend to ramp up their fund purchases at the top of the stock market cycle. The below chart shows the one year forward return (blue line) along with the current period mutual fund flows.

(click chart for larger image)

The result of this poor market timing is investors' long run returns tend to be lower than the market returns since they miss the top performing market days.

(click chart for larger image)

It has been said a number of times in this recent market environment, that the best time to buy stocks is when it feels the most uncomfortable. October made this difficult to believe given the punishment the market took in that month. In fact, Friday's (10/31/08) positive market advance was the first time the Dow Jones Industrial Average recorded two consecutive up days since September 26th.

It has been said a number of times in this recent market environment, that the best time to buy stocks is when it feels the most uncomfortable. October made this difficult to believe given the punishment the market took in that month. In fact, Friday's (10/31/08) positive market advance was the first time the Dow Jones Industrial Average recorded two consecutive up days since September 26th.(click chart for larger image)

Overcoming the emotional aspects of the market can be tough; however, maybe investment opportunities are surfacing in this type of market environment.

Source:

Stock Market: Exit At Your Own Risk ($)

Market Analysis, Research & Education

A unit of Fidelity Management & Research Company

October 16, 2008

http://personal.fidelity.com/products/publications/

No comments :

Post a Comment