Standard & Poor's recently published a paper noting that dividends are not only a critical component of total return, but dividends serve as a cushion in down markets. The paper notes:

- Historically, dividends have contributed nearly one-third of the equity return of the S&P BMI World Index, while capital appreciation has contributed approximately two-thirds.

- When bond yields are low, income oriented investors can switch to dividend paying stocks to enhance current income.

- Dividends allow investors to capture the upside potential while providing downside protection in the down markets.

In looking at the period "August 1989 to September 2008, dividends contributed approximately 28% of the total equity return of the S&P BMI World Index, while price appreciation contributed roughly 72%. From August 1999 to September 2008, dividend income accounted for as much as 52.05% of total return."

The below chart details the contribution of dividends to the monthly total returns of the S&P BMI World Index over the last 19 years.

The below chart details the contribution of dividends to the monthly total returns of the S&P BMI World Index over the last 19 years.

(click chart for larger image)

(click chart for larger image)

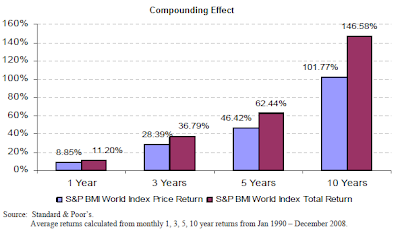

Lastly, the compounding of dividends adds significantly to the total return of ones investment. For the 18-year period from January 1990 to December 2008 the price only return for the S&P BMI World Index totaled 101.77% versus the total return (dividends included) on the World Index over that same time period of 146.58%.

Lastly, the compounding of dividends adds significantly to the total return of ones investment. For the 18-year period from January 1990 to December 2008 the price only return for the S&P BMI World Index totaled 101.77% versus the total return (dividends included) on the World Index over that same time period of 146.58%.(click charts for larger image)

In the end, pursuing an investment strategy that incorporates dividend paying stocks can serve to enhance ones return in down markets. Additionally, the S&P report notes the importance of dividends to the overall return of an index or more specifically stocks.

Source:

Dividend Investing (PDF)

Standard & Poor's

By: Aye M. Soe and Srikant Dash, CFA, FRM

October 2008

http://www2.standardandpoors.com/spf/pdf/index/Dividend_Investing.pdf

No comments :

Post a Comment