Posted by

David Templeton, CFA

at

9:15 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

10:46 PM

0

comments

![]()

![]()

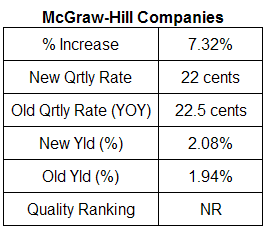

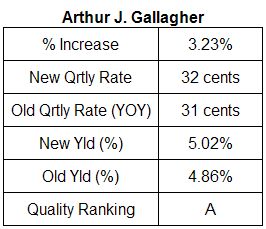

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

11:38 PM

2

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

8:03 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

"If the I/S ratio rises, it is generally a sign that spending is slowing since inventories (numerator) are rising amid lackluster demand. Higher I/S ratios, therefore, imply economic softness. Businesses (retailers, wholesalers, and manufacturers) don’t want to be caught with deep inventories amid a pullback in spending. The latest available data suggest that the inventories/sales ratio is 1.24, or 1.24 months of available stock give the current pace of sales. And since this measure is approaching an all-time low, and is not exhibiting any recessionary upward trend like it did leading up to the 2001 recession, we believe that a major economic downturn is not in the cards."

Posted by

David Templeton, CFA

at

12:37 PM

1

comments

![]()

![]()

Labels: Economy

Posted by

David Templeton, CFA

at

8:51 AM

0

comments

![]()

![]()

Labels: Dividend Analysis

In today's release of the American Association of Individual Investors' sentiment survey, it is reported bearish sentiment jumped to a level not seen since 1990. The bearishness level rose to 59.02% versus last week's level of 54.44%. The bullishness level moved slightly higher to 25.14% versus last week's 24.30%. The bull/bear spread also widened to a negative -34% versus -30% last week. A graph of the bullishness level is detailed below.

Posted by

David Templeton, CFA

at

7:46 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

9:04 PM

0

comments

![]()

![]()

Labels: Technicals

"Examples of noncore earnings include capital gains, profits from exchange rate fluctuations and pro forma income on investments of pension plans. Expenses left out by some companies included stock options (which weren’t booked as expenses but served as a form of compensation) and restructuring charges."

Posted by

David Templeton, CFA

at

11:19 PM

0

comments

![]()

![]()

Labels: Investments

"In response to the market breaks in October 1987 and October 1989 the New York Stock Exchange instituted circuit breakers to reduce volatility and promote investor confidence. By implementing a pause in trading, investors are given time to assimilate incoming information and the ability to make informed choices during periods of high market volatility."

Posted by

David Templeton, CFA

at

5:03 PM

1

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

9:12 AM

0

comments

![]()

![]()

Labels: International , Technicals

EDITOR'S CHOICE

The Sun, in the Center at Political Calculations

* Commentary *

The price dividend growth rate ratio will set the pace for what investors can expect from the stock market.

Market Response to Recessions at A Dash of Insight

* Economy *

The most important question for investors and traders is how much of the slowing economy is already reflected in forecasts, earnings projections, and stock prices. If the recession really is underway, hasn't the market already reflected reduced earning potential?

COMMENTARY

Patrick Byrne “screws up” Overstock.com and the board of directors rewards him at the Fraud Files blogECONOMY

Baltic Index Down 37% Since Mid November at Bespoke Investment Group

Every once in a while, an economic term or indicator that was previously not widely followed finds its way into the mainstream financial conversation. One indicator du jour is the Baltic Dry Freight Index. Many economists consider the index to be a good leading indicator of economic activity. If not as many people are looking to move cargo, ships will be in less demand, causing a drop in the price that shippers can charge. However, declines in the index do not necessarily mean that a recession is on the horizon.

EDUCATION

Top 10 Pages To Read First In Investors Business Daily at Millionaire Neumes

Investor's Business Daily newspaper is packed with information and can be overwhelming to a new user. Here are the 10 pages I always read.

FINANCIAL ANALYSIS

When Is A Lot of Cash A Bad Thing? at Dividends4Life

Shareholders no longer will tolerate companies building large cash reserves as they have in the past.

Stocks: TSR

NEW WEB BLOGS

Campus Stocks - Social Networking for Student Investors at 5 Percent Stocks

Five Percent Stocks establishes new social networking website for student investors. He he notes in his post, "now has come the time for these universities to battle it out on the stock ticker.

STOCKS

AeroGrow Invents New Industry and Continues Growing at Nabloid: Advice From Beyond

Nabloid discusses a potentially up and coming new product sold by Aerogrow. This company company sells indoor gardens to individuals with Aergrow's gardens using an aeroponics process to supply a nutrient solution and water to the plants in this table table indoor garden product.

Stocks: AERO

Reliance Power: An Indian IPO at Living Off Dividends

Why India's largest IPO brings back memories of Enron.

Stocks: RELFF

TAXES

50 Tools and Resources for Freelancers During Tax Season at Bootstrapper

Estimated payments, deductions, and extra forms is enough to make your head spin. This collection of advice, tools, and resources could ease your stress and get you on the right track for this year’s tax season.

ANALYSIS TOOLS

How to Estimate Earnings Growth with Excel at luminouslogic.com

This post explains how to use an Excel program to evaluating a company's financial statements and forecast future financial results.

Thanks to all who submitted great investing and finance related posts. To submit your blog article to the next edition of the Festival of Stocks you can use the carnival submission form. Past posts and the next hosts can be found on the blog carnival index page. If you are interested in hosting a Festival of Stocks post, visit Value Investing News' host page.

Posted by

David Templeton, CFA

at

5:20 PM

1

comments

![]()

![]()

Labels: General Market

Unfortunately for strategists with an intermediate-term time horizon (six to 12 months), while there have been 11 recessions since 1945, there have been 49 pullbacks, 16 corrections, and 10 bear markets. Therefore 64 of these 75 market sell-offs incorrectly anticipated the 11 eventual recessions. What's more, these alignments usually didn't last very long. Pullbacks typically recovered in about two months, while corrections righted themselves in fewer than four months. So it is imperative that we be confident of a recession before we call for defensive posturing.

Posted by

David Templeton, CFA

at

11:44 AM

2

comments

![]()

![]()

Labels: Economy , General Market

The above chart shows historical data back three years. A longer term view is noted below. The chart and commentary is courtesy of The Big Picture website in the post titled, NYSE % of stocks > than 200 Day Moving Average. The chart shows the 21% of stocks above their 200 day MA is still higher than lows achieved in 2998 and 2002.

The above chart shows historical data back three years. A longer term view is noted below. The chart and commentary is courtesy of The Big Picture website in the post titled, NYSE % of stocks > than 200 Day Moving Average. The chart shows the 21% of stocks above their 200 day MA is still higher than lows achieved in 2998 and 2002.

Posted by

David Templeton, CFA

at

9:36 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

7:35 AM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

7:56 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

7:17 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

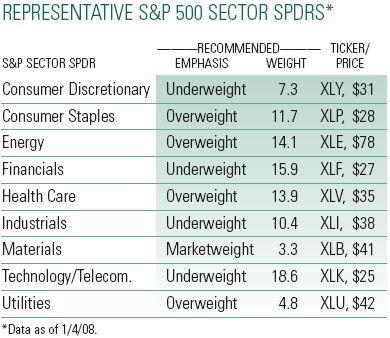

The danger is that the foreign economies may weaken more than expected. Europe and Japan have both relied on trade surpluses to offset soft domestic demand. Can these regions improve their domestic demand enough to offset the weaker exports to the U.S.?S&P's recommended sector weightings are noted below.

Posted by

David Templeton, CFA

at

2:14 PM

1

comments

![]()

![]()

Labels: Economy

These indicators measure the financial health of a company, how well their products are selling, and whether they are able to maintain and even increase a very high level of profitability. A company that scores very high across all eight of these mental model variables is highly likely to have all the characteristics of a potential 10-bagger growth stock.

"These indicators measure the financial health of a company, how well their products are selling, and whether they are able to maintain and even increase a very high level of profitability. A company that scores very high across all eight of these mental model variables is highly likely to have all the characteristics of a potential 10-bagger growth stock.

I cannot emphasize enough that you need to use all of these variables when seeking market-beating growth stocks to add to your portfolio. Why not just focus on one or two variables that have performed the best over time?

There will be periods of time when the market favors stocks with earnings momentum, and periods where operating cash flow or earnings before interest, taxes, depreciation and amortization (EBITDA) are the darlings of the day. As soon as the dance cards are full and everyone can be found chasing after the same thing, the band will stop and the party will be over.

Instead you should focus on all eight variables. The amount each variable counts may be changed or tweaked over time, but all eight variables need to be considered.

By concentrating on the numbers, and just the numbers, you can take the guesswork out of picking winning stocks."

Posted by

David Templeton, CFA

at

8:59 PM

0

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

10:12 PM

0

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

6:57 AM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

7:23 PM

0

comments

![]()

![]()

Labels: Technicals

The S&P 500 Index has declined -3.84% to start off 2008. Following are links to articles covering investment strategies for volatile markets.

Posted by

David Templeton, CFA

at

4:54 PM

0

comments

![]()

![]()

Labels: Investments

- "The decline in dividend increases reflects the current trend of favoring stock buybacks at the expense of committing to long-term cash dividends," says Howard Silverblatt, Senior Index Analyst at Standard & Poor’s.

- Standard & Poor’s data reveals that negative actions - such as dividend decreases and suspensions - picked up in 2007 amidst heightened concern over the current difficulties within the Financials and Consumer Discretionary sectors. Dividend extras - such as one-time dividend payments and special dividends - increased 1.0% (versus 14.3% in 2006) to 628 from 622 during 2006.

- Howard Silverblatt notes that, while dividend increases within the general market have declined, over 60% of the S&P 500 companies increased their dividend payment in 2007. In addition, Silverblatt estimates that S&P 500 dividend payments will increase 9.3% in 2008.

- "History shows that S&P 500 issues have a greater likelihood to pay dividends than the general market, 78% versus less than 39% for the general market," adds Silverblatt. "In addition, S&P 500 issues have a much greater propensity to increase their dividend rate than the general market."

Posted by

David Templeton, CFA

at

9:12 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

7:32 AM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

9:06 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Source: Standard & Poor's

Source: Standard & Poor's

Posted by

David Templeton, CFA

at

6:53 PM

0

comments

![]()

![]()

Labels: Dividend Return

Posted by

David Templeton, CFA

at

10:52 PM

0

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

4:54 PM

0

comments

![]()

![]()

Labels: Investments

Sources:

Sources:

Posted by

David Templeton, CFA

at

1:14 PM

0

comments

![]()

![]()

Labels: Investments