|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:07 PM

0

comments

![]()

![]()

Labels: Week Ahead

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:24 AM

0

comments

![]()

![]()

Labels: Sentiment

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

"Following periods when short-term rates ease, lending activity and subsequently business development typically accelerate. During these periods value stocks, led by financial and industrial companies, begin to outperform. As the global economy begins to expand, demand for basic materials, such as metals, and energy related commodities, such as oil and natural gas, rises. That leads to an increase in the price of these commodities which in turn has historically led to the outperformance of the stocks of commodity producers and processors."

"As in the case of an economic slowdown, the monetary response to economic expansion is also typically delayed until sustained signs of acceleration in inflation are apparent. In response, central banks begin to hike short-term interest rates to the point where the interest rate yield curve is flat or inverted, i.e. short-term rates are either equal to or higher than long-term rates. Lending activity to businesses then typically slows significantly, profits of financial institutions decline, and financial stock prices begin to lag the market averages. Economic activity moderates, and once again those stocks that can grow their earnings at the fastest pace, namely, growth stocks, typically resume a period of multi-year outperformance."

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:00 AM

0

comments

![]()

![]()

Labels: General Market , Investments

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

1:04 PM

0

comments

![]()

![]()

Labels: General Market , Valuation

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

4:41 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

"The Wealthy Hand-to-Mouth," by economists at Princeton and New York University, finds that roughly one-third of American households -- 38 million of them -- are living a paycheck-to-paycheck existence. These are families who hold little to no liquid wealth from cash, savings or checking accounts. But a staggering two-thirds of these households are not actually poor; while they resemble poor families in their lack of liquid wealth, they own substantial holdings ($50,000, on average) in illiquid assets (emphasis added). Because this money is locked up in things like their houses, cars and retirement accounts, they can't easily dip into it when times get tough.

Posted by

David Templeton, CFA

at

5:00 AM

0

comments

![]()

![]()

Labels: Financial Planning , General Market

Posted by

David Templeton, CFA

at

1:32 PM

0

comments

![]()

![]()

Labels: Week Ahead

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:30 AM

0

comments

![]()

![]()

Labels: Financial Planning , Investments

|

| From The Blog of HORAN Capital Advisors |

"The growth of mobile devices and the increased accessibility of online pricing have helped fuel increased Web sales. Through the first three quarters of 2013, e-commerce sales increased by 17.4% over the same period in 2012 [according to the U.S. Census bureau]. Today, consumers increasingly turn to their smartphones and tablets to comparison shop on multiple sites simultaneously, rather than travel from store to store for the lowest prices. Purchases can often be delivered within a day or two, at either a nominal shipping expense or free of charge. Further, merchandise returns have been streamlined, as many e-commerce retailers send prepaid return shipping labels to customers with their purchases, removing yet another obstacle to shopping online."

Posted by

David Templeton, CFA

at

5:06 PM

0

comments

![]()

![]()

Labels: Investments

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

8:32 PM

0

comments

![]()

![]()

Labels: Sentiment

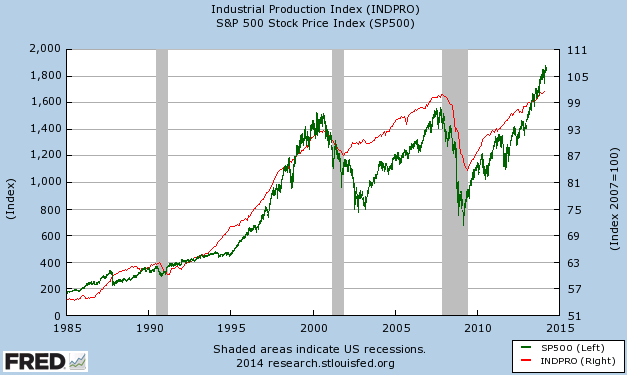

"Manufacturing production recorded an increase of 0.8 percent in February after having decreased 0.9 percent in January. Much of the swing in the rates of change for production in January and February reflected the depressing effects on output of the severe weather in January and the subsequent return to more normal levels of production in February. The level of factory output in February was 1.5 percent above its year-earlier level. Capacity utilization for manufacturing moved up 0.5 percentage point in February to 76.4 percent, a rate 2.3 percentage points below its long-run average."

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

2:54 PM

0

comments

![]()

![]()

Labels: Economy , General Market

Posted by

David Templeton, CFA

at

5:22 PM

0

comments

![]()

![]()

Labels: Week Ahead

|

| From The Blog of HORAN Capital Advisors |

"The broader index may be making new all-time highs, but less and less of its components are. This means the market is being driven higher by fewer and fewer companies and solely by those companies with the biggest market caps that have the larger effects on the indices (emphasis added)."

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:43 AM

0

comments

![]()

![]()

Labels: General Market , Technicals

- "The Dow Jones Industrial Average has soared 151% since stocks bottomed March 9, 2009, following the financial crisis. That ranks it fifth in gains among the 32 bull markets since 1900."

- "It also is tied for fifth-longest-running, in trading days, with the one that ended in 2007, according to Ned Davis Research."

- "If the current stock advance lasts another 16 trading days, it will be the fourth-longest, surpassing the one that ended in 1987."

- "The Nasdaq Composite Index is up 242%, and the Russell 2000 small-stock index is up 251% in that time. A bull market is commonly defined as a gain of at least 20% from a market low."

Posted by

David Templeton, CFA

at

11:10 PM

0

comments

![]()

![]()

Labels: Week Ahead

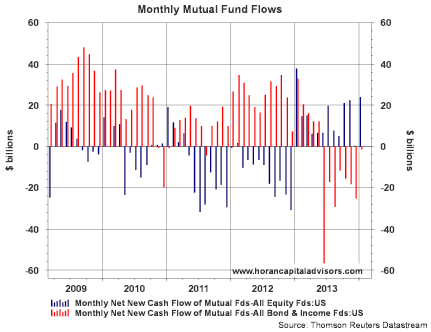

- Tuesday was the largest single-day outflow ever for BlackRock Inc.'s (BLK) iShare's fixed-income ETFs, a spokeswoman said.

- Some $6.2 billion poured out of bond ETFs on Tuesday as investor concerns over Ukraine cooled, driving a global stock-market rally and a selloff in safe-haven bonds.

- Tuesday's bond ETF withdrawal was equal to roughly 2.5% of the $240 billion bond ETF market, according to research and analysis firm ETF.com. In contrast, some $1.9 billion flowed into U.S. stock funds Tuesday, representing 0.2% of total assets.

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:51 AM

0

comments

![]()

![]()

Labels: Bond Market , General Market , Technicals

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:04 PM

0

comments

![]()

![]()

Labels: Dividend Analysis , Dividend Return

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

1:42 PM

0

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

8:45 PM

0

comments

![]()

![]()

Labels: Week Ahead

Jobless claims are not pointing to any improvement in the labor market with initial claims up 14,000 in the February 22 week to a 348,000 level that's just outside the high end of the Econoday consensus. The 4-week average is unchanged at 338,250 which is slightly higher than the month-ago trend in a reading that points to no improvement (emphasis added) for the monthly employment report.

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:42 PM

0

comments

![]()

![]()

Labels: Economy