Last week the Federal Reserve's release of assets and liabilities for commercial banks showed C&I loans continued to increase at a robust pace. Additionally, today's industrial production figure exceeded expectations with a .6 percent increase in February versus a decline of .2 percent in January. The report noted February's manufacturing output rose 0.8 percent. This followed a .9 percent decline in January. The report also noted that factory production had its largest increase since last August. Specifically,

"Manufacturing production recorded an increase of 0.8 percent in February after having decreased 0.9 percent in January. Much of the swing in the rates of change for production in January and February reflected the depressing effects on output of the severe weather in January and the subsequent return to more normal levels of production in February. The level of factory output in February was 1.5 percent above its year-earlier level. Capacity utilization for manufacturing moved up 0.5 percentage point in February to 76.4 percent, a rate 2.3 percentage points below its long-run average."

The below chart compares industrial production (a coincident indicator) to commercial and industrial loans at all commercial banks.

|

| From The Blog of HORAN Capital Advisors |

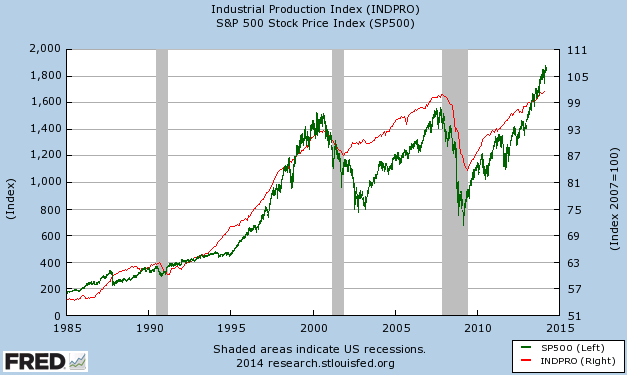

And finally, the improvement in Industrial Production does coincide with an improved equity market as can be seen in the below chart.

|

| From The Blog of HORAN Capital Advisors |

The above three measures are now reaching post recession highs. Maybe there is truth to the often cited weather related impact with recent earnings releases. As we leave winter behind, pent-up demand could drive further improvement in economic activity.

No comments :

Post a Comment