Sunday, February 23, 2014

Week Ahead Magazine: February 23, 2014

Posted by

David Templeton, CFA

at

1:32 PM

0

comments

![]()

![]()

Labels: Week Ahead

Corporate Profit Margins Not At A Peak

|

| From The Blog of HORAN Capital Advisors |

- Corporate Profit Margins Likely to Fall: Here's Why (Seeking Alpha-2/13/2011)

- An Ominous Sign For Profits (Young Research Publishing Inc.-4/1/2011)

- Stock Market's Next Hurdle: Peak Earnings (CNNMoney-3/22/2012)

- Stocks Headed Lower As Corporate Profits Peak And Households Rein In Spending (Seeking Alpha-7/16/2012)

- The Coming Retreat In Corporate Earnings ( Hussman Funds-12/16/2013)

"A profit margin is commonly defined as profits divided by revenues. GDP is an aggregate expenditure in the economy, which is definitely not equal to aggregate corporate revenues. It is reasonable to expect that profits as a share of GDP and profit margins are correlated but they are not the same thing. A meaningful ratio would instead divide profits, which is the income of corporations, by total income in the economy. This new ratio I interpret as the share of total income that goes to corporations: not the profit margin, but the profit share."

"My second point is that the number in the numerator of the “profit margin” on the chart above comes from national income figures. It includes profits generated by corporations with legal residence in the U.S., regardless of whether those profits came from U.S. operations or foreign operations. This measure of profit includes income earned by Amazon in the United Kingdom, and excludes income earned in the U.S. by Toshiba. GDP, on the other hand, captures economic activity within U.S. borders, whether it is done by U.S. companies or foreign companies, and excludes activity by U.S. companies abroad. It is misleading to compare these two magnitudes: worldwide profits of U.S. corporations and GDP generated within U.S. borders."

"To be more specific, I have estimated the trend of my two time series, foreign and domestic, of the profit share. As of 2008, the last year for which I estimate the trend, the "normal" (i.e. trend) profit share was 12.5%. If it had continued rising at the same pace as it did in 1988-2008 as of 2012 the "normal" profit share would be 13.2%. The actual profit share was 14.4%: still too high, but by 9%, not by 70% as Hussman says (last chart below)."

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Source:

Viewpoint on Corporate Profits

By: Francisco Torralba, Ph.D., CFA

Morningstar Investment Management

February 5, 2014

https://corporate.morningstar.com/ib/documents/TargetMaturity/Viewpoint%20on%20Corporate%20Profits.pdf

Posted by

David Templeton, CFA

at

12:58 PM

0

comments

![]()

![]()

Labels: General Market , Investments

Saturday, February 22, 2014

S&P 500 Companies Accelerate Buybacks

"Buybacks have been the rage, but companies are going to have to spend 30% more to buy back the same number of shares in 2014 as they did in 2013 (since prices have gone up). The share count is more relevant to EPS, and on that count, we are seeing a greater number of companies reducing their share counts, which is providing a tailwind to earnings. Apple Inc., which holds the quarterly record of $16 billion in buybacks posted in the second quarter of 2013, already purchased $14 billion in the first two weeks of January."

|

| From The Blog of HORAN Capital Advisors |

Disclosure: Family long AAPL

Posted by

David Templeton, CFA

at

9:47 AM

0

comments

![]()

![]()

Labels: Dividend Analysis , General Market

Thursday, February 20, 2014

Market In Long Term Uptrend

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:52 AM

0

comments

![]()

![]()

Labels: Technicals

Wednesday, February 19, 2014

A Market Consolidating Before New Highs Ahead?

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:05 PM

0

comments

![]()

![]()

Labels: Technicals

Monday, February 17, 2014

The Week Ahead Magazine: February 17, 2014

Posted by

David Templeton, CFA

at

6:26 PM

0

comments

![]()

![]()

Labels: Week Ahead

Saturday, February 15, 2014

Dividend Payers A Losing Strategy In January

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

7:57 PM

0

comments

![]()

![]()

Labels: Dividend Return

Wednesday, February 12, 2014

1929 Crash: Charts That Mislead Investors

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:22 AM

0

comments

![]()

![]()

Labels: General Market , Technicals

Sunday, February 09, 2014

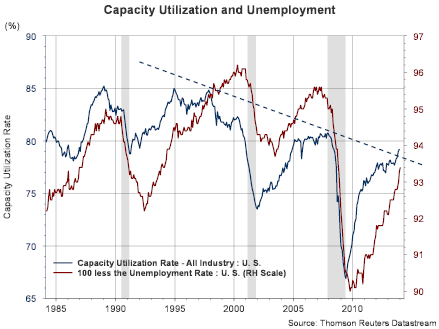

Employment Growth Key To Economy Achieving "Escape Velocity"

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

The CBPP report noted:

...At the average pace of 167,000 jobs a month achieved so far, it will take another 5 months for employment to exceed its level in December 2007 — and much longer to reach full employment, since the population and potential labor force are now larger. Economic growth will have to pick up substantially to reach those goals sooner (emphasis added.)

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

"In the past, there was a fairly close contemporaneous relationship between capacity utilization and unemployment. However, much like the relationship between output and unemployment, a lag in the relationship has developed in the last two recessions (see graph). That is, in past recessions an upturn in capacity utilization was matched by an upturn in employment, there was no delay in the relationship, but in recent recessions there has been about a half year delay before unemployment reacts to changes in capacity utilization (or perhaps even a bit longer)."

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:05 PM

0

comments

![]()

![]()

Labels: Economy

The Week Ahead Magazine: February 9, 2014

Posted by

David Templeton, CFA

at

5:19 PM

0

comments

![]()

![]()

Labels: Week Ahead

Monday, February 03, 2014

Volatility Returns

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

- 2/5: ADP Employment Report

- 2/5: Non-Manufacturing ISM Index

- 2/6: Chain Store Sales

- 2/7: Employment Situation Report

Posted by

David Templeton, CFA

at

11:08 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

Looking For An Excuse To Sell: Emerging Markets, PMI's And Hedge Fund Shorts

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

"An emerging meme posits that the recent weakness in quite a few emerging market currencies (e.g., Argentina, Venezuela, Brazil, Chile, Turkey) is a replay of the S.E. Asian currency crisis of 1997-98, and as such this may persuade the Fed to back off on its intention to continue its QE taper. I disagree, because there are some very important differences between now and then."

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

12:46 PM

0

comments

![]()

![]()

Labels: Economy , General Market , International

Sunday, February 02, 2014

The Week Ahead Magazine: February 2, 2014

Posted by

David Templeton, CFA

at

2:12 PM

0

comments

![]()

![]()

Labels: Week Ahead