One frequently cited aspect of this recovery has been the slow pace of economic growth since the end of the recession and the negative impact on employment growth. We have often referred to this as bump along the bottom economic growth. Is there an underlying cause contributing to this slow pace of economic growth? At HORAN we believe there is, but let's look at some of the economic data.

The final GDP report in the third quarter of 2013 was reported at an annual rate of 4.1%. The first read on GDP for the fourth quarter was reported at a lower 3.2% annual rate. The U.S. Department of Commerce's BEA estimates GDP for all of 2013 equals 1.9%. This is lower than the 2.8% reported for 2012. As the below chart shows the slow rate of growth since the end of the financial crisis has created a 15% gap versus the economy's long term potential growth rate.

|

| From The Blog of HORAN Capital Advisors |

A consequence of this below trend growth has been a stubbornly high unemployment rate. The unemployment rate has declined, yet this recovery has not resulted in employment reaching the level prior to the recession as the two below charts show. In January the unemployment rate declined to 6.6% while the broader U-6 rate equals 12.7%.

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

The CBPP report noted:

...At the average pace of 167,000 jobs a month achieved so far, it will take another 5 months for employment to exceed its level in December 2007 — and much longer to reach full employment, since the population and potential labor force are now larger. Economic growth will have to pick up substantially to reach those goals sooner (emphasis added.)

Notable in this recovery is the fact the corporate sector has been performing well. The strength of the stock market since the bottom of the recession is one confirming data point. Just looking at corporate net cash flow and corporate cash flow as a percentage of GDP, both are at elevated levels. For companies to exhibit a high level of cash flow is a positive. A high level of cash flow as a percentage of GDP is not a positive when economic growth, or GDP, is below trend level. The green line in the below chart shows the strength of corporate net cash flow. If the economy were growing at a trend growth rate, cash flow to GDP would equal 12.4% as denoted by the maroon dot.

|

| From The Blog of HORAN Capital Advisors |

Companies have been using this flow to reinvest in their business, increase dividends and increase stock buybacks. Non residential fixed investment, a GDP input defined as expenditures by firms on capital such as commercial real estate, tools, machinery, and factories, has surpassed the level prior to the recession. And on a percentage change basis, the peak growth following the recession matches the level achieved subsequent to prior recoveries (see below chart.) Of concern is this reinvestment rate is slowing to levels reached prior to the onset of past recessions.

|

| From The Blog of HORAN Capital Advisors |

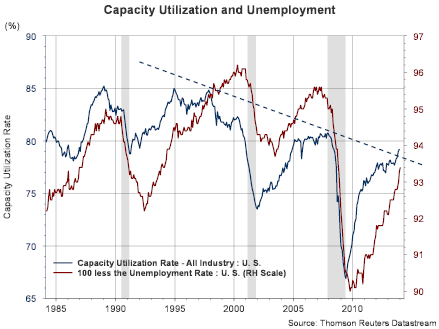

Business reinvestment has occurred in spite of a capacity utilization rate below historical levels. Additionally, as capacity utilization has increased, the level of employment has not kept pace with this increased manufacturing activity. We wrote about this in a blog post in 2010, Is The Economy Rolling Over? In that article we reference the utilization rate and employment level which was first noted by Mark Thoma, a professor of economics at the University of Oregon. He noted in an article on his Economist's View website,

"In the past, there was a fairly close contemporaneous relationship between capacity utilization and unemployment. However, much like the relationship between output and unemployment, a lag in the relationship has developed in the last two recessions (see graph). That is, in past recessions an upturn in capacity utilization was matched by an upturn in employment, there was no delay in the relationship, but in recent recessions there has been about a half year delay before unemployment reacts to changes in capacity utilization (or perhaps even a bit longer)."

|

| From The Blog of HORAN Capital Advisors |

As the above chart shows, the capacity utilization rate has finally broken above a resistance level that began in 1998. This higher capacity utilization is a positive for employment and we believe it is this increased level of hiring that can push the economy into its so-called "escape velocity." But what might be restraining hiring by companies?

There is some debate whether small businesses create more jobs than larger businesses. It is universally accepted that small businesses are responsible for a significant portion of new job creation. However, when looking at business failures, and thus, net jobs created, studies indicate small businesses do not have a decided advantage. Interestingly though, the National Small Business Association recently released its 2014 Healthcare survey. The survey notes that 96% of the small businesses surveyed have been in business for more than six years. The entire survey provides interesting insight into the small business operator's view of the current economic climate.

|

| From The Blog of HORAN Capital Advisors |

Source: NSBA Health Care Survey

Fully 34% of those surveyed noted they are holding off hiring due to the uncertainty around health care regulation. Additionally, 24% are holding off the implementation of strategies that would improve the growth of their firm.

In addition to the uncertainty surrounding the Affordable Care Act, increased regulation under Washington's oversight has made it more difficult for new businesses as well as existing ones to expand. If issues with health care reform could be resolved as well as reducing the regulatory burden on companies, a higher level of employment would likely follow. We have discussed on our blog a number of times about the broad based benefits of higher private sector employment. But having policies in place that are favorable to businesses could certainly push the economy into its "escape velocity."

No comments :

Post a Comment