|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

12:37 PM

0

comments

![]()

![]()

Labels: Economy , General Market

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

4:44 PM

0

comments

![]()

![]()

Labels: General Market , International

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:02 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:42 PM

1

comments

![]()

![]()

Labels: Bond Market , Economy , General Market

The improvement in the unemployment rate earlier this month was certainly positive on the surface. The rate declined to 8.6% from the previously reported 9%. The improvement though came largely from the 300,000 individuals that simply stopped looking for a job. As a result, these additional people are not counted among the unemployed. As the below chart shows, the number individuals not in the labor continues to rise.

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:08 AM

0

comments

![]()

![]()

Labels: Economy

- Year-to-date (YTD) dividend payers in the S&P 500 have returned 1.72%, compared to the non-payers loss of 4.63%.

- The actual dividend payment YTD is up 16.2%.

- The indicated dividend rate (based on the current rate) is up 16.8% YTD, but still off 4.9% from the June 2008 high.

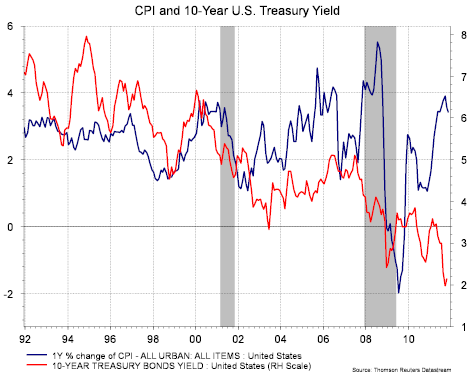

- From 1995 the S&P 500 indicated dividend yield has averaged 43% of the U.S. 10-year Treasury note, the current rate is 105%.

- 215 issues have a current yield higher than the 10-year Treasury.

Posted by

David Templeton, CFA

at

6:13 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:50 PM

0

comments

![]()

![]()

Labels: Economy

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

7:12 PM

0

comments

![]()

![]()

Labels: Economy

“the LEI is pointing to continued growth this winter, possibly even gaining a little momentum by spring. The lack of confidence has been the biggest obstacle in generating forward momentum, domestically or globally. As long as it lasts, there is a glimmer of hope.”

|

| From The Blog of HORAN Capital Advisors |

- Industrial production rose 0.7% in October

- Chicago PMI rose to 62.6 from 58.4, a seven-month high, and the new orders component rose to its highest level since March at 70.2

- The Institute for Supply Management’s (ISM) Manufacturing Index rose to 52.7, the highest level since June

- New orders increased to 56.7 from 52.4

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:32 PM

0

comments

![]()

![]()

Labels: Economy , General Market , International

“the problems in the eurozone are nothing new: too much debt from eurozone member countries to over-leveraged European financial institutions. Adding to the woes is the lack of global competitiveness among many of the zone's members, thanks to the tying of 17 vastly different economies and policies to one (too-strong) currency. The lack of a single fiscal authority within the eurozone that's capable of enforcement or supervision has allowed the problems to fester and the can to be continually kicked down the road (emphasis added).”

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:31 PM

0

comments

![]()

![]()

Labels: Economy , General Market