One primary reason cited for a choppy start to this week's market is the anticipation surrounding Friday's employment report. If the report is anything like recent mixed economic reports, it will not provide clarity on the economy's future direction. The job environment is one reason for the tepid economic recovery. As the below chart shows, consumption accounts for over 70% of GDP. If consumers are unemployed and/or spending more frugally, GDP or economic growth will be constrained.

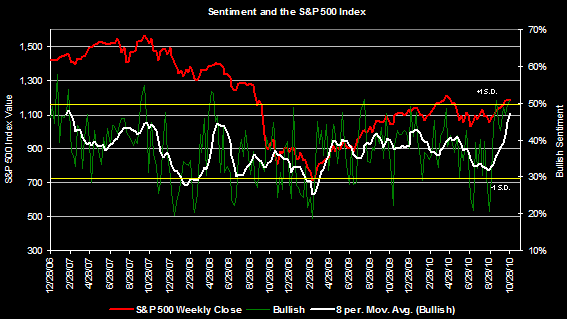

In spite of this mixed economic environment, the market's advance in the third quarter can be characterized as one in which it climbed a wall of worry; however it wasn't a steady climb higher.

From a pure technical standpoint, the market's recent action seems to show it is attempting to form a base near the 1,118 level on the

S&P 500 Index. Of some concern is several of the technical indicators are rolling over, i.e., stochastic oscillator and the MACD. The

On Balance Volume (OBV) indicator has been in a longer term downtrend since early May as well. The numerical value of the OBV is not important, but rather the direction of the line. Investors should focus on the OBV trend and its relationship with a security's price. In short, one should expect the market to digest gains achieved in the third quarter. Support can be found at the 200-day moving average on the

S&P 500 Index around 1,118.

At

HORAN Capital Advisors, we remain cautiously optimistic about the market. An anticipated near term pullback will likely give investors an opportunity to work some cash into equities before the November elections in the U.S.