By and large we have been positive on the markets since mid summer as our prior posts and newsletters have noted. A number of factors contributed to our positive market bias including attractive large cap stock valuations and our belief the economy was/is not going into a double dip recession. Since July of this year, the S&P 500 Index is up 15+% with most of the gain coming since the beginning of September. From September 1st through the close today, the S&P is up 10.8%. It is not reasonable to think the market can move higher by 10+% every two months. The market may not move higher by 10% every two months, but it seems individual stocks like Apple (AAPL) are trying.

So what is on our mind at this point in time as we evaluate the future direction of the market?

- Mutual fund flows have seen strong flows into fixed income/bond funds over the last three years while at the same time investors have withdrawn funds from equity mutual funds. However, over the last two weeks, equity funds are finally experiencing positive in flows. primarily international equities. The question then is whether investors are now beginning to buy bequonds near a top?

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Source:ICI

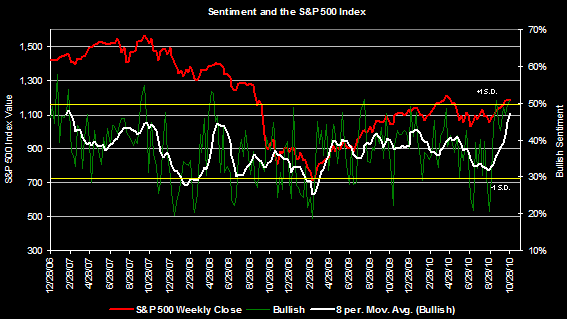

- Individual investor sentiment as reported by the American Association of Individual Investors indicates bullish sentiment is beginning to move in to an overly bullish zone. Bullish investor sentiment has increased from 24.68% at the beginning of July to 51.23% reported this week. The long term average for the bullishness level is 39% with an 11% standard deviation. The bull/bear spread stands at 30% and has been as high as 75%.

|

| From The Blog of HORAN Capital Advisors |

- As our third quarter newsletter touched on, market sentiment resulting from a change of control in congress seems to be weighing positively on the market as well. The question then becomes, how much of a potential Republican majority is factored into current stock prices. What are the market implications if the outcome is not as expected. As many investors know, the markets trade on expectations and surprises can be market moving.

At the end of the day, we believe investors need to focus on fundamentals and valuations at this point in time. One could say this should always be the case and they would be right. However, there are times when the market favors momentum based stocks and pushes them higher regardless of valuation.

The markets have a lot to digest over the next several months:

- election outcome

- expiration of the Bush tax cuts: higher taxes for consumers while consumer spending accounts for 70% of GDP.

- impact of a lame duck Congress

No comments :

Post a Comment