|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

11:31 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

"Our customers are focused on their savings, and they need us now more than they ever have. Unemployment, we all know, remains mid-9s and doesn't appear to be going anywhere quickly. Gas prices are high. They don't appear to be going anywhere. We need to figure out how to operate in this environment.

The paycheck cycle we've talked about before remains extreme. It is our responsibility to figure out how to sell in that environment, adjusting pack sizes, large pack at sizes the beginning of the month, small pack sizes at the end of the month. And to figure out how to deal with what is an ever-increasing amount of transactions being paid for with government assistance.

And you need not go further than one of our stores on midnight at the end of the month. And it's real interesting to watch,about 11 p.m., customers start to come in and shop, fill their grocery basket with basic items, baby formula, milk, bread, eggs, and continue to shop and mill about the store until midnight, when electronic -- government electronic benefits cards get activated and then the checkout starts and occurs. And our sales for those first few hours on the first of the month are substantially and significantly higher.

And if you really think about it, the only reason somebody gets out in the middle of the night and buys baby formula is that they need it, and they've been waiting for it. Otherwise, we are open 24 hours -- come at 5 a.m., come at 7 a.m., come at 10 a.m. But if you are there at midnight, you are there for a reason. And we have to look at that and we have to watch that and we have a commitment to serve those customers who need that. And we are very, very focused on that."

Posted by

David Templeton, CFA

at

10:08 AM

0

comments

![]()

![]()

Labels: Economy

Posted by

David Templeton, CFA

at

4:39 PM

0

comments

![]()

![]()

Labels: Investments

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

2:46 PM

0

comments

![]()

![]()

Labels: Bond Market , General Market , Investments

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:39 PM

0

comments

![]()

![]()

Labels: Sentiment

The yield is calculated by taking the latest declared dividend, annualized and divided by the stock price. Payout ratios are calculated based on latest quarterly dividend paid divided by earnings. The data is first sorted by the industry name alphabetically and then by the yield in descending order. Dividends are paid on a quarterly basis unless noted.

Posted by

David Templeton, CFA

at

12:40 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

7:58 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

8:18 AM

0

comments

![]()

![]()

Labels: Economy

|

| From The Blog of HORAN Capital Advisors |

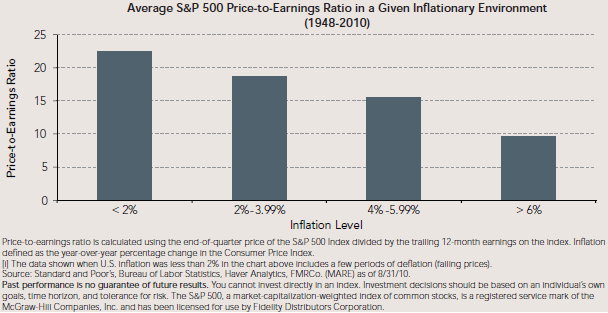

As of July 2010, year-over-year inflation stood at 1.3%, while the S&P 500’s P/E ratio (using trailing 12-month earnings) was 15.6 as of August 2010—somewhat below the index’s historical average (17.7).

Using earnings forecasted over the next 12 months (to August 2011) the market’s P/E ratio was 14.1 as of the end of August—also below the index’s long-term average. Thus, given the low current level of inflation and both trailing and forward-looking measures of earnings, the stock market’s current valuation is somewhat below historical norms.

Posted by

David Templeton, CFA

at

8:31 PM

0

comments

![]()

![]()

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

8:58 PM

1

comments

![]()

![]()

Labels: Economy

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:18 PM

0

comments

![]()

![]()

Labels: International , Investments

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:24 PM

2

comments

![]()

![]()

Labels: Dividend Return

| From Horan Capital Advisors Blog |

| From Horan Capital Advisors Blog |

Posted by

Nick Reilly

at

5:42 PM

0

comments

![]()

![]()

Labels: Alternatives , Asset Allocation