Disclosure: Long ABT, GE

Posted by

David Templeton, CFA

at

5:25 PM

0

comments

![]()

![]()

Labels: Investments

|

|

|

Posted by

David Templeton, CFA

at

2:08 PM

1

comments

![]()

![]()

Labels: General Market , Technicals

|

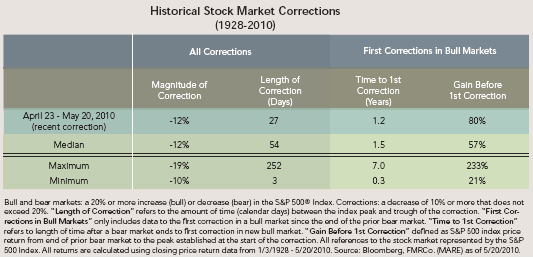

- It’s been about 14 months since the current bull market began on March 9, 2009, which is in the neighborhood of the average length of time that has passed from the start of prior bull markets to a first correction (17 months, see above table).

- The stock market gained 80% before the recent correction. Historically, the first correction in a new bull market has come after average gains of 57%, implying the current bull market was overdue for a correction on a price appreciation basis.

- The main factor that has differentiated this recent correction is that it has taken place at a fairly swift pace compared to history. It took 27 days for the market to surpass the 10% decline threshold, which is half the time it’s historically taken on average for a correction to occur (54 days).

- Since 1926, there have been 20 stock market corrections during bull markets, meaning 20 times the market declined 10% but did not subsequently fall into bear market territory. Whether the market recovers again from here and avoids a bear market remains to be seen, but at the very least the more surprising development based on historical patterns would have been a continued bull market rally without a 10% pause.

Posted by

David Templeton, CFA

at

9:29 AM

0

comments

![]()

![]()

Labels: General Market , Technicals

Posted by

David Templeton, CFA

at

12:43 PM

0

comments

![]()

![]()

Labels: General Market , Sentiment

|

"the number of days in the past year that the S&P 500 fell by 2% or more in a single day began to accelerate. Indeed, May 4 and May 6 were the two most recent times the 500 dropped 2% or more in a single session. In the past 12 months (ended May 14), the 500 fell by 2% or more 13 times vs. an average of seven per year since 1970. Of course, these readings are nowhere near the peak of 54 declines experienced in mid-2009 as a result of the megameltdown in equity prices."

|

Posted by

David Templeton, CFA

at

11:33 AM

0

comments

![]()

![]()

Labels: General Market , Investments

HORAN Capital Advisors expands on the larger HORAN organization by expanding on HORAN's wealth management services. The combination of HORAN’s well-established wealth management practice combined with the intellectual capital and depth of experience of HORAN Capital Advisors creates a strong resource for individuals, families, and institutions.

HORAN Capital Advisors expands on the larger HORAN organization by expanding on HORAN's wealth management services. The combination of HORAN’s well-established wealth management practice combined with the intellectual capital and depth of experience of HORAN Capital Advisors creates a strong resource for individuals, families, and institutions.

Posted by

David Templeton, CFA

at

10:30 AM

0

comments

![]()

![]()

Labels: Investments

|

Investors have reason to worry about future prospects for bond returns—history shows that current low yields may be expected to result in below-average performance, especially if interest rates rise. Investors particularly concerned about the possibility of rising rates may want to diversify their fixed-income portfolios into less interest-rate sensitive sectors. However, the great bond bear market of 1941-1981 also offers some more comforting lessons as well. High-quality bonds are much less volatile instruments than stocks, and they do not lose that attribute during periods of rising rates. Even during a prolonged period of rate increases, owning bonds lowered the volatility and improved the risk-adjusted returns of an overall investment portfolio. As a result, investors may not look with much excitement at the near-term outlook for bond returns, but that doesn’t mean they should over-react by shunning bonds altogether.

Posted by

David Templeton, CFA

at

10:46 PM

0

comments

![]()

![]()

Labels: Bond Market

- Industrial production jumped up at an annualized rate of 10.0 percent in April, following an upwardly revised 2.5 percent gain in March.

- Over the past 12 months, industrial production is up 5.2 percent, its highest growth rate since June 2000.

- The University of Michigan Index of Consumer Sentiment edged up in early May, increasing from an index value of 72.2 to 73.3.

- Both the current conditions and consumer expectations components posted modest increases, contributing to the overall increase.

- Total retail sales rose 0.4 percent (nonannualized) in April, following an upwardly revised 2.1 percent jump in March.

- Over the past 12 months, retail sales have risen 8.8 percent (their highest growth rate since July 2005).

- New orders for manufactured goods increased 1.3 percent (nonannualized) in March, following an upwardly revised 1.3 percent jump in February.

- New orders excluding transportation rose 3.1 percent in March and are now up 15.6 percent over the past year.

- The I/S ratio for manufactured goods continues to decline from its peak reading of 1.47 months in January 2009 to 1.27 months.

- The ISM’s Manufacturing Purchasing Managers Index (PMI) continued improve in April, increasing 0.8 index point to 60.4 (its highest level since June 2004), following a 3.1 point jump in March.

- The new orders index jumped up from 61.5 to 65.7 in April, continuing its rebound from an all-time low of 22.9 in December 2008.

- The production index rose 5.8 points to 66.9 during the month, marking its eleventh month above the diffusion index growth threshold of 50.

- The employment index surged to 58.5 its highest level since January 2005.

- Nonfarm payroll employment grew by 290,000 in April, topping expectations for roughly a 200,000 gain. Census hiring inflated April’s figure by 66,000, but private payrolls still increased 231,000 when discounting the government’s boost.

- Revisions to February and March figures were solid as well, tacking on an additional 121,000 jobs and leaving those months’ respective gains at 39,000 and 230,000.

- Jobs in goods-producing industries expanded by 65,000, and services expanded 166,000, its largest increase in over three years.

|

Posted by

David Templeton, CFA

at

10:52 PM

0

comments

![]()

![]()

Labels: Economy , General Market

|

Posted by

David Templeton, CFA

at

2:42 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

You can completely avoid one or the other, or you can compromise between the two, but you can’t eliminate both. One of the prominent features of investor psychology is that few people are able to (a) always balance the two risks or (b) emphasize the right one at the right time. Rather, at the extremes they usually obsess about the wrong one . . . and in so doing make the other the one deserving attention.

During bull markets, when asset prices are elevated, there’s great risk of losing money. And in bear markets, when everything’s at rock bottom, the real risk consists of missing opportunity. Everyone knows these things. But bull markets develop for the simple reason that most people are buying – ignoring the risk of loss in order to keep from missing opportunity – just when elevated prices imply losses later. Likewise, markets reach their lows because most people are selling, trying to avoid further losses and ignoring the bargains that are everywhere.

Posted by

David Templeton, CFA

at

5:24 PM

0

comments

![]()

![]()

Labels: General Market , Sentiment

|

Posted by

David Templeton, CFA

at

11:14 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

|

|

Posted by

David Templeton, CFA

at

8:51 PM

0

comments

![]()

![]()

Labels: Economy , General Market

Posted by

David Templeton, CFA

at

8:24 PM

0

comments

![]()

![]()

Labels: Economy , General Market , International

|

|

Posted by

David Templeton, CFA

at

11:56 PM

0

comments

![]()

![]()

Labels: General Market

|

Posted by

David Templeton, CFA

at

10:50 PM

0

comments

![]()

![]()

Labels: Dividend Return

The tough part with the selling in May strategy this time around is where does an investor go with the cash. As the above table shows, even the low rates of return in the May to October period would be better than money market investments in this market. As a recent Bloomberg BusinessWeek article notes, the May to October period has seen gains in 12 of the last 20 years. The Sell in May and Go Where? article provides an investor with some areas of the market that have tended to perform well during this period, i. e., Health Care and Staples are a couple of sectors.

The tough part with the selling in May strategy this time around is where does an investor go with the cash. As the above table shows, even the low rates of return in the May to October period would be better than money market investments in this market. As a recent Bloomberg BusinessWeek article notes, the May to October period has seen gains in 12 of the last 20 years. The Sell in May and Go Where? article provides an investor with some areas of the market that have tended to perform well during this period, i. e., Health Care and Staples are a couple of sectors.

Posted by

David Templeton, CFA

at

11:43 PM

1

comments

![]()

![]()

Labels: General Market , Technicals