In an effort to look past the health care rhetoric, one aspect of the legislation that we know is coming is higher tax rates. In addition to the higher taxes that are a apart of the new legislation, the Bush tax cuts will expire after 2010 as well. So what does history say about higher taxes and stock prices.

It has been 23 years since capital gains tax rates were increased. The last increase occurred when Ronald Reagan was president. A big part of what Reagan did with taxes was lower the highest marginal tax rate on income from 50% to 28%. However, Reagan did increase the tax rate on capital gains from 20% to 28% beginning in January 1987. What occurred in 1986 was the unleashing of the corporate raider. A recent article in Financial Advisor magazine noted:

It was the age of the corporate raider and folks like T. Boone Pickens. Carl Icahn and Ronald Perelman were making the CEOs of America's biggest companies quake in their stretch limos. With a huge assist from Drexel Burnham Lambert's junk bond department in Beverly Hills, these characters were putting companies into play on a weekly basis. The rest of Wall Street was frantically scrambling to clone Drexel's incredible profit machine and struggling to create their junk bond units to finance LBOs....

When the 1986 tax act became law, these raiders sensed opportunity and took off on a bender that would last for more than two years. Shareholder value was their mantra. Almost every day, they would tee up companies and demand that their boards work over time to quickly complete the deal to give shareholders the full advantage of the soon-to-expire 20% capital gains tax rate. In actuality, most raiders were hoping that a bigger corporation, or so-called white knight, would swoop in and trump their offers.

Did the expiration of the 20% capital gains tax rate in January 1987 hurt stock prices? Hardly. From January to September, equities went crazy. Propelled perhaps by the big cut in income tax rates, the Dow climbed from 1,897 to over 2,700 on August 25 in a frenzy that looked like a runaway train going down Mt. Everest.

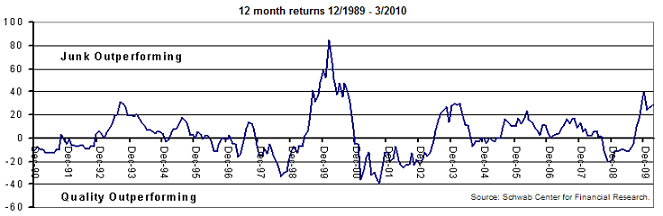

The fall out from this junk bond era is well know, but it is worth noting that stocks performed well during this time period. For bond holders, they should have some knowledge of history.

Fed chairman Paul Volcker discerned the all-too-obvious symptoms of an overheating economy and decided he'd had enough of all this nonsense. In April, he jacked up interest rates dramatically, triggering a $100 billion bath for bondholders around the globe.

One aspect that is different this time is income taxes will be on the rise. David Kelly, chief market strategist for J.P. Morgan Funds notes:

- starting in 2013, the Medicare tax rate on households with income over $250,000 will be increased from 1.45% to 2.35%.

- a new 3.8% Medicare tax will be introduced for this same group on investment income.

- the tax rate on dividends and long-term capital gains will increase from 15% to 20% for households earning over $250,000 and with the new Medicare tax, these rates will rise to 23.8% for the same group.

- Under current tax law, investors get to keep 85% of the income stream from taxable stock market investments. Under this new law this will be cut by 8.8% to 76.2%, reducing the value of the income stream by 10.4% (that is 8.8% of 85%).

- using a number of broad assumptions, the value of the average stock should be reduced by one quarter of 10.4% or 2.6%—not good obviously, but also not an overwhelming reason to avoid stocks after a 12 month period in which they rose by over 70% and still appear undervalued.

Certainly, an investor's income stream will be impacted by the higher tax rates. The question becomes what are the alternatives to stocks and dividend paying stocks for that matter? If the Fed is preparing to raise interest rates (maybe not until later this year), what will be the impact on bonds? Additionally, with the precarious budget situation with a number of municipalities, tax free bonds may not be the safe haven expected by many investors. In short, don't let the tax tail wag the dog. Some perspective on history is contained in the article,

Animal Spirits: The Last Time Capital Gains Taxes Rose.

Source:

Animal Spirits: The Last Time Capital Gains Taxes RoseFinancial Advisor Magazine

By: Evan Simonoff

March 25, 2010

http://www.fa-mag.com/blog/evan-simonoff/5357-animal-spirits-the-last-time-capital-gains-taxes-rose.htmlInvestment Implications of Health Care ReformFinancial Advisor Magazine

By: David Kelly, chief market strategist for J.P. Morgan Funds

March 22, 2010

http://www.fa-mag.com/online-extras/5344-investment-implications-of-health-care-reform.html