Today, Standard & Poor's reported dividend and buyback activity for the first quarter of 2008 for the S&P 500 Index. Although buybacks continue at a rate exceeding $100 billion and dividends exceed $60 billion, the buyback and dividend trend is not positive.

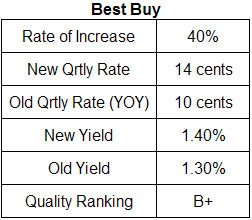

One critical aspect of a dividend growth investment discipline is to look at the change in the dividend growth rate of a particular company. For those knowledgeable in calculus, it is the second derivative that is important. Although the growth rate may be positive, the rate may be lower than the prior period. This means the rate of change (second derivative) is negative. If the dividend growth rate is slowing, is this a precursor to slowing earnings growth? A number of factors other than the dividend growth rate are important criteria to review, e.g., payout ratio, dividend yield, etc, but the slowing rate of dividend growth is certainly a yellow flag.

Getting back to the S&P 500 Index buyback and dividend detail for the first quarter of 2008, although difficult to tell, the YOY dividend growth rate is slowing, i. e., the second derivative is negative. Additionally, the below chart notes the sequential dividend and buyback total for the first quarter is lower than in the 4th quarter of 2007.

(click on chart for larger image)

This could be a signal that earnings growth for the S&P 500 Index is set to turn negative at some point in the near future? The 1st quarter of 2008 represents the second quarter in a row that the level of buybacks has declined. The decline in the dividend total is the first decline since a decline was recorded in the 1st quarter of 2006.

Source:

S&P 500 Stock Buybacks Retreat in Q1 But Remain Strong (pdf)

Standard & Poor's

By: David Guarino & Howard Silverblatt

http://www2.standardandpoors.com/portal/site/sp/en/us/page.article/2,3,2,2,1204837108299.html

Not surprisingly, the financial sector was a major contributor to the weak performance this year. The only financial stock in the top ten is Aflac (AFL). As the below spreadsheet shows, most of the banks fall in the bottom third of the table from a year to date performance perspective. The full spreadsheet can be seen at this link.

Not surprisingly, the financial sector was a major contributor to the weak performance this year. The only financial stock in the top ten is Aflac (AFL). As the below spreadsheet shows, most of the banks fall in the bottom third of the table from a year to date performance perspective. The full spreadsheet can be seen at this link.