An important factor many investors understand is investing in stocks is a long term commitment. The primary reason for a long term time horizon when investing in stocks is the volatility stocks can exhibit over the course of any single year.

The chart below details the annual returns of the S&P 500 Index since 1926. Many investors expect returns from stocks to average around 10%. In fact that is the average return when going back to 1926. Interestingly, since 1926, the S&P 500 Index has returned between 8%-10% in only four years.

The chart below details the annual returns of the S&P 500 Index since 1926. Many investors expect returns from stocks to average around 10%. In fact that is the average return when going back to 1926. Interestingly, since 1926, the S&P 500 Index has returned between 8%-10% in only four years.

(click on chart for larger image)

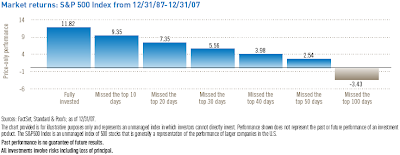

Also evident from the chart is the fact that the S&P 500 Index has more positive years than negative. The other important fact to be aware of is missing just a few of the big up days in the market can significantly reduce ones returns. The below chart shows what an investor's returns would be if they missed a few of those big up days in the market since 1987.

(click on chart for larger image)

As the above chart depicts, if an investor missed just 40 of the biggest up days in the market over the last 20 years, their return would have totaled 3.98% versus remaining fully invested and achieving a average annualized return of 11.82%.

In the end, investing in stocks is something one should consider if they have a long term time perspective. Since market timing is difficult to implement successfully, if one misses the big up days in the market that tends to occur, returns will be far below the long term average.

In the end, investing in stocks is something one should consider if they have a long term time perspective. Since market timing is difficult to implement successfully, if one misses the big up days in the market that tends to occur, returns will be far below the long term average.

Source:

The Rewards of Long-Term Investing

Legg Mason

2008

http://www.leggmason.com/individualinvestors/education/index.aspx

No comments :

Post a Comment