Earlier this week Best Buy (BBY) reported an increase in earnings per share, while at the same time, reported net income actually declined. In the company's earnings release they reported a significant level of stock buyback activity. For the year the company repurchased 75.6 million shares of stock or nearly 16% of the shares outstanding. The cost of the buyback to the company was an estimated $3.5 billion dollars.

As an investor one needs to ask if this level of buyback is an indication by the company/board of future business prospects. If the company had committed to paying a higher dividend on an ongoing basis, this could have been viewed more positively. A higher dividend payment might be an indication the company sees sustainable earnings growth out into the future. The buyback is a one time activity; thus, not committing the company to higher cash outflow going forward. Therefore, are there clues in the financial reports that might indicate a slowing in the business?

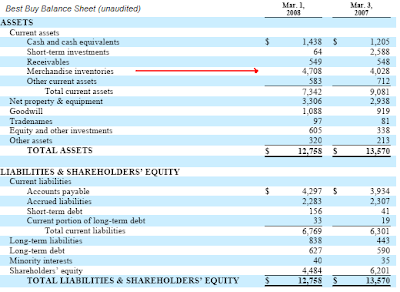

The company has yet to file its 10-K, but they plan on filing by the end of April. One can look at some of the financial information included in the 8-K to get a sense for the business activity. One piece of information to note is merchandise inventory saw an increase of almost 17% as noted below. This rate of increase compares to an increase in revenue of 4% when comparing the quarter ending 3/1/2008 to the same quarter last year. It should be noted that the 4th quarter included one less week than last year. Adjusting for this difference, revenue would have increased 9%. So, is inventory at a higher level than the company anticipated due to sales not meeting the company's expectations? Also, will this inventory need to be cleared out of stores at lower selling prices; thus impacting future margins and earnings? The company does note in the 8-K that it has seen a shift in customers' desire for higher ticket items like gaming systems.

As an investor one needs to ask if this level of buyback is an indication by the company/board of future business prospects. If the company had committed to paying a higher dividend on an ongoing basis, this could have been viewed more positively. A higher dividend payment might be an indication the company sees sustainable earnings growth out into the future. The buyback is a one time activity; thus, not committing the company to higher cash outflow going forward. Therefore, are there clues in the financial reports that might indicate a slowing in the business?

The company has yet to file its 10-K, but they plan on filing by the end of April. One can look at some of the financial information included in the 8-K to get a sense for the business activity. One piece of information to note is merchandise inventory saw an increase of almost 17% as noted below. This rate of increase compares to an increase in revenue of 4% when comparing the quarter ending 3/1/2008 to the same quarter last year. It should be noted that the 4th quarter included one less week than last year. Adjusting for this difference, revenue would have increased 9%. So, is inventory at a higher level than the company anticipated due to sales not meeting the company's expectations? Also, will this inventory need to be cleared out of stores at lower selling prices; thus impacting future margins and earnings? The company does note in the 8-K that it has seen a shift in customers' desire for higher ticket items like gaming systems.

(click on table for larger image)

Best Buy is the premier electronic retailer, but these items are worth watching.

No comments :

Post a Comment